UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| | | | | |

Filed by the Registrant x |

| |

Filed by a party other than the Registrant o |

| |

| Check the appropriate box: |

| |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material under §240.14a-12 |

THE PROGRESSIVE CORPORATION

| | | | | | | | | | | | | | |

| (Name of Registrant as Specified In Its Charter) |

| | | | |

| | | | | | | | | | | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check all boxes that apply): |

| | | |

| x | | No fee required |

| | | |

| ¨ | | Fee paid previously with preliminary materials |

| | | |

| ¨ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Progressive Corporation (NYSE:PGR) will hold its Annual Meeting of Shareholders on Friday, May 12, 2023,10, 2024, at 10:00 a.m., eastern time. The meeting will be held by online audio webcast only. There will be no physical location for the meeting. You will be able to attend the Annual Meeting, vote, and submit your questions during the meeting via live audio-only webcast by visiting virtualshareholdermeeting.com/PGR2023PGR2024.To participate in the Annual Meeting, you must have your 16-digit control number that is shown on your proxy card. You will not be able to attend the Annual Meeting in person.

At the Annual Meeting, shareholders will be asked to:

1.Elect as directors the 12 nominees identified in the attached Proxy Statement, each to serve for a term of one year;

2.Cast an advisory vote to approve our executive compensation program;Approve The Progressive Corporation 2024 Equity Incentive Plan;

3.Cast an advisory vote on the frequency of the advisory vote to approve our executive compensation program;

4.Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2023;2024;

5.Act on a shareholder proposal, if properly presented; and

5.6.Transact such other business as may properly come before the meeting.

The foregoing items of business are described more fully in the Proxy Statement accompanying this Notice. Only shareholders of record of The Progressive Corporation at the close of business on March 17, 2023,15, 2024, are entitled to receive notice of and to vote at the meeting or any adjournment or postponement of the meeting.

Your vote is important. Whether or not you plan to participate in the meeting via the live audio-only webcast, please vote by Internet or telephone (following the instructions on the enclosed proxy card), or by completing and returning the proxy card in the enclosed postage-paid envelope. If you later choose to revoke your proxy or change your vote, you may do so by following the procedures described in the Proxy Statement's “Questions and Answers about the Annual Meeting and Voting” section in the attached Proxy Statement.section.

By Order of the Board of Directors,

Daniel P. Mascaro,David M. Stringer, Secretary

March 27, 202325, 2024

The Proxy Statement and the 20222023 Annual Report to Shareholders

are also available at progressiveproxy.com

A MESSAGE FROM THE BOARD OF DIRECTORS

March 27, 202325, 2024

To Progressive’s shareholders:

Coming into 2022, manySince 2020, Progressive has experienced very challenging business conditions resulting from the global pandemic, changing work patterns, global supply disruptions, and inflation, among other significant factors. In 2023, we continued to operate in a volatile environment. While our policies in force (PIFs) and net written premiums continued to grow significantly, our combined ratio, the commonly used measure of usour profitability, came under pressure during the first part of the year. Progressive’s core objective—to grow as fast as possible while preserving a 4% profit margin and serving customers well— demanded that quick and decisive actions be taken. The leadership team demonstrated great flexibility, cohesion, and grit in deciding what to do and executing well. Their efforts were cautiously optimistic thatsuccessful. Despite disappointing profitability results in the first part of the year, would bring initial steps towardthe full year results met the guiding objectives, with companywide growth in PIFs and net written premiums of 9% and 20%, respectively, and a full year combined ratio of 94.9.

The Board of Directors is delighted not just with the results, which speak for themselves, but with the energy, optimism, and nimbleness displayed by the entire Progressive team during another challenging year.

I encourage you to read more normal operating environment forabout Progressive’s extraordinary accomplishments in 2023 in the most recent letter from Progressive’s Chief Executive Officer, Tricia Griffith, which accompanies our 2023 Annual Report. In addition to reviewing 2023 and sharing important information about Progressive’s strategies and goals, Tricia’s letter provides a window into Progressive’s unique culture. We believe that culture not only supports the company’s continuing efforts to attract, retain, and develop talented people, but is key to enabling all of Progressive’s people to work together as a cohesive team to deliver exceptional results.

Continuing with the theme of culture, the Board continues to believe that Progressive’s diversity, equity, and inclusion (DEI) efforts have been an important contributor to the company’s performance. As Tricia explains in her letter, DEI at Progressive is about enabling every Progressive person to contribute fully, to connect and engage with their work and their colleagues, and to enjoy the world at large, although we did not necessarily anticipate a quick turnaround given the depth of the turbulencevast professional opportunities that we had seen over the prior couple of years. Well, it’s a good thingare available in Progressive’s thriving business. We also believe it important, and differentiating, that Progressive rallies its people enjoy a good challenge, because 2022 ended up being full of them! Whether it was the business impacts of inflation and investment volatility, rapidly changing driving behavior as pandemic restrictions continued to ease, or the largest catastrophe in company history (Hurricane Ian), the company and its employees once again demonstrated their talent for proactive and forward-thinking problem solving. Despite these challenges, the team achieved impressive results and positioned the company for future success.

It is the Board’s job both to oversee the “here and now” and to focus on longer-term opportunities and challenges, and our work in 2023 reflects those dual responsibilities. We were actively involved in advising and supporting management, monitoring results, overseeing risks and controls, and staying close to developments in the business by receiving regular reports about a wide variety of operating metrics as well as hearing “deep dive” presentations at Board meetings. Tricia and her senior team provided frequent updates between meetings.

At the same time, our annual program of work ensured that we spent ample time on three critical areas of long-term Board oversight: strategy, the evolving risk environment, and the bench of leadership talent for the future.

As always, this space does not permit a detailed recitation of the Board’s activities, but we want to highlight a few areas.

•Our annual multi-day, deep dive on the company’s strategy took place early in the year, just as some of the economic disruptions were coming into focus. It provided not only an excellent opportunity to evaluate and provide feedback on management’s current and longer-term plans, but also to probe and question those plans against the dynamic environment unfolding around us. The immersion in strategy and detailed presentations from each member of senior management provided a valuable foundation to on-going discussions and decisions throughout the year.

•Oneincluding its Core Values and Purpose, its clearly defined profitability objective, and its annual Gainshare incentive program that is available to nearly every Progressive person. In challenging times such as 2023, our performance depends upon energizing all Progressive people to bring their unique capabilities to solve problems and execute on common business goals.

As a Board, we have regular opportunities to engage with Progressive’s employees, including interaction with members of the major responsibilitiesemployee resource groups, advisory councils, development programs, and leaders. We leave these interactions impressed with the caliber of Progressive people and the level of engagement, ownership, and pride they project in their work, culture, and organization. We have great confidence not just that Progressive’s current leaders are focused on the right priorities, but that Progressive is investing wisely in building tomorrow’s leaders. And while Progressive looks at engagement scores internally as its measure of workplace success, we believe the company’s many workplace awards are a testament to its leading position as an employer of choice.

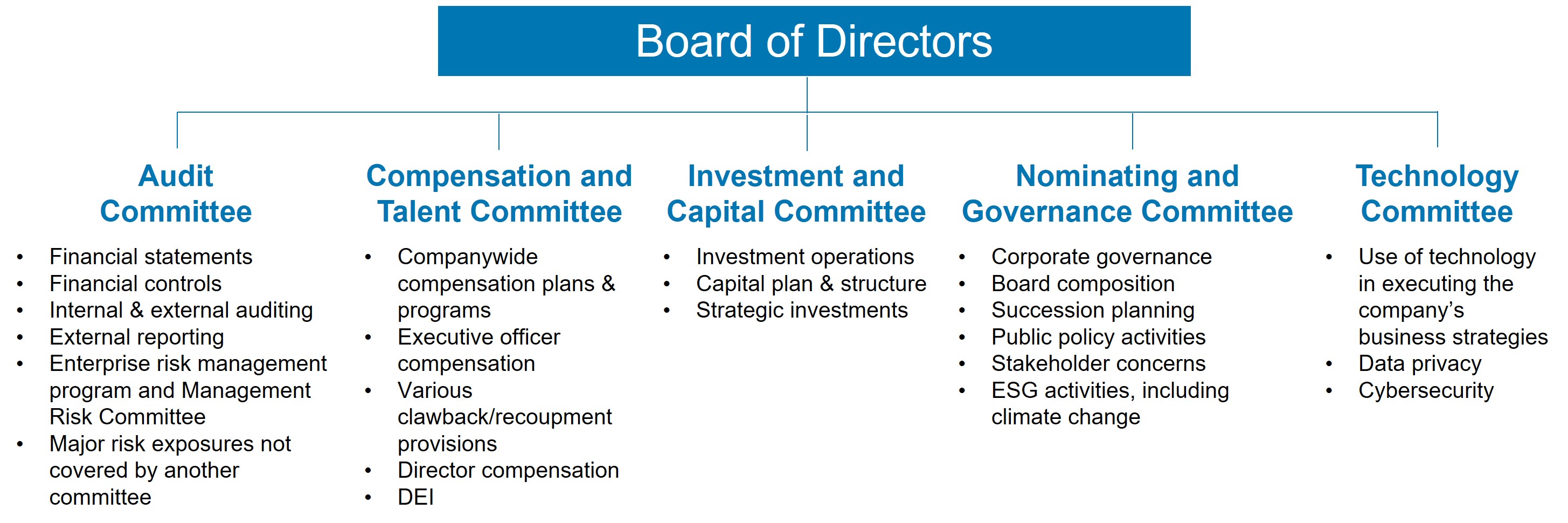

To ensure this extraordinary talent is well focused on delivering value to stakeholders, the Board is the oversight of riskalso continues to be highly engaged in overseeing Progressive’s business strategy and risk management. The Board recognizes its role and ongoing commitment to strong corporate governance practices, which we believe enhance long-term shareholder value. The Board, through its committees, oversees the company’s financial reporting, investment activities, technology and cybersecurity risks, and environmental and social considerations. The committees receive regular updates regarding the changing regulatory landscape and we discuss related trends and opportunities both in committees and as a full Board. We continue to devote attention to climate-related challenges, and we regularly discuss with management activities. Progressive has a very well-developedclimate change risk management processbroadly and risk framework that is usedProgressive’s efforts toward carbon neutrality in particular.

Our Annual Meeting this year will be held virtually on May 10, 2024. We moved to identifyvirtual meetings during the pandemic and monitorfound it works well for our shareholders. We encourage you to attend. Even if you don’t plan to attend the risks in the business, articulate risk appetites and track risk mitigation activities. It is a living document under constantmeeting, we hope you will review and amendment as conditions change. At the Board, oversight of the risk management process itself is the responsibility of the Audit Committee. Oversight of major categories of operating risks has been assigned to the Board committees best suited to address them. For example, consideration of financialour proxy statement and internal control risks rests with the Audit Committee. Cybersecurity risks are overseen by the Technology Committee. The Investment and Capital Committee has active oversight of investment risk. Each committee reports on its activities to the full board on a regular basis. In addition, at least once a year, the Board receives a comprehensive presentation on risk management activities and their evolution from the prior year.

•While we have written at length in the past about the company’s operating activities, we do not often write about our oversight of investment activities, but they are a critical aspect of Progressive’s strength and competitive position. The Progressive Capital Management group manages a pool of capital in excess of $50 billion that meets regulatory obligations, provides additional capital to mitigate risk in the business and, equally importantly, provides a platform that enables Progressive to grow its businesses. Investment markets in 2022 were exceptionally challenging as the outlook for interest rates changed, inflation expectations gyrated, and the likelihood of recession remained a subject of debate. Through the Investment and Capital Committee, the Board oversees the asset allocation, risk positioning and results of the investment portfolio and provides advice and support to the investment team. In addition, the full board hears detailed presentations directly from the investment team about market conditions, investment strategy, talent development, investment results and other topics in an annual visit to the capital management team’s offices.vote your shares.

•The final – and perhaps most important – area of Board focus is talent development and succession planning throughout the organization. We often discuss this topic in detail with senior executives and receive an annual presentation from Tricia and the team that reviews talent acquisition, training, retention and development in detail. We also seek to see future leaders for ourselves, so we encourage regular opportunities for high performers to present directly to the Board and its committees. These sessions typically involve a subject matter expert presenting in their area of expertise, which not only enhances our understanding of the many complex topics faced by the company, but just as importantly, gives us the chance to assess these senior leaders’ knowledge and skills and, more broadly, their potential to become future leaders. From this perspective, we are continually impressed with the quality and diversity of the management “bench” available and rigorous approach to leadership development that Progressive demonstrates. We believe it to be a huge competitive advantage.

We are pleased to have the many challenges of 2022 behind us and enter the new year hopeful, once again, for improvements that will benefit Progressive, the broader economic environment, and the world at large. We do so, however, with open eyes that the ongoing challenges, and unexpected obstacles, will undoubtedly require further active and nimble responses by Progressive. We embrace this uncertainty and look forward to continuing to work hard for the company’s shareholders and other stakeholders.

We would like to thank Progressive’s employees for their hard work and customer focus during these trying times. We would also like to thank shareholders for your continuing ownership interest in The Progressive Corporation.

On behalf of the Board of Directors, I thank all of Progressive’s over 61,000 employees for their coordinated and collaborative approach to challenges during 2023, and I thank you for your ongoing investment in The Progressive Corporation.

/s/ Lawton W. Fitt

Lawton W. Fitt

Chairperson of the Board

THE PROGRESSIVE CORPORATION

PROXY STATEMENT

TABLE OF CONTENTS

THE PROGRESSIVE CORPORATION

PROXY STATEMENT

GENERAL INFORMATION REGARDING PROXY MATERIALS AND

THE ANNUAL MEETING OF SHAREHOLDERS

The Board of Directors (Board) of The Progressive Corporation (NYSE:PGR) (Progressive or Company) provides this Proxy Statement to you to solicit your proxy to act upon the matters outlined in the accompanying Notice of Annual Meeting of Shareholders, each described in more detail in this document.

The Annual Meeting will take place on Friday, May 12, 2023,10, 2024, at 10:00 a.m., eastern time, via a live audio-only webcast that is available at virtualshareholdermeeting.com/PGR2023PGR2024. There will be no physical meeting location and the meeting will only be conducted via the live audio-only webcast to allow for greater participation by all of our shareholders, regardless of their geographic location. Your proxy also may be voted at any adjournment or postponement of the meeting.

The proxy card, this Proxy Statement, and Progressive’s 20222023 Annual Report to Shareholders will be mailed to shareholders beginning on or about March 27, 2023.25, 2024.

All proxies that are properly completed and submitted over the Internet or by telephone, and all properly

executed written proxies, will be voted at the meeting in accordance with the directions given by the shareholder, unless the shareholder properly revokes their proxy before voting occurs at the meeting. If a shareholder executes and delivers their proxy card without directions on how to vote their shares, then the shares represented by the proxy card will be voted as recommended by the Board.

Only shareholders of record of The Progressive Corporation's common shares, $1.00 par value, at the close of business on March 17, 2023,15, 2024, the record date, are entitled to receive notice of and to vote at the meeting or any adjournment or postponement of the meeting. Each shareholder on the record date is entitled to one vote for each of our common shares held by the shareholder. On the record date, we had 585,366,448585,698,431 common shares outstanding.

For additional information regarding the proxy materials and the Annual Meeting, see “Questions and Answers Aboutabout the Annual Meeting and Voting” in this Proxy Statement.

| | | | | | | | | | | | | | |

| WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, THE BOARD OF DIRECTORS STRONGLY ENCOURAGES YOU TO VOTE YOUR SHARES BY PROXY PRIOR TO THE MEETING. YOUR VOTE IS IMPORTANT. PLEASE FOLLOW THE VOTING INSTRUCTIONS CAREFULLY TO MAKE SURE THAT YOUR SHARES ARE VOTED APPROPRIATELY. |

PROXY STATEMENT SUMMARY

This summary highlights certain information contained in this Proxy Statement. ItStatement and includes a summary of our 2023 business performance and various business strategies. This summary also highlightsdiscusses our approach to sustainability, environmental, (including climate change), social, and governance (ESG) initiatives, summarizes our, human capital management, efforts, provides a brief description of our 2022 business performance, and summarizes stakeholder engagement efforts. It

The Proxy Statement Summary does not contain all of the information you should consider when voting your shares. Please read the entire Proxy Statement and Annual Report to Shareholders carefully before voting. For additional information about how to vote your shares, including voting options and standards, see “Questions and Answers about the Annual Meeting and Voting” in this Proxy Statement.

VOTING MATTERS AND BOARD RECOMMENDATION

| | | | | | | | | |

| Item Number | Voting Matter | Board Recommendation | |

| 1 | Elect as directors the 12 nominees identified in this Proxy Statement, each to serve for a term of one year | FOR each

nominee | |

| 2 | Approve The Progressive Corporation 2024 Equity Incentive Plan | FOR | |

| 3 | Cast an advisory vote to approve our executive compensation program | FOR | |

3 | Cast an advisory vote on the frequency of the advisory vote on our executive compensation program | ONE YEAR | |

| 4 | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 20232024 | FOR | |

| 5 | Act on a shareholder proposal, if properly presented | AGAINST | |

PROGRESSIVE AT A GLANCE

The Progressive insurance organization has been offering insurance to consumers since 1937. We are the second largest private passenger auto insurer in the country, the number one writer of commercial auto insurance, and the 10th largest homeowners insurance carrier, in each case, based on 2022 premiums written.

As our name implies, we were founded on the principle of moving forward, taking new risks, and learning and growing together. As we look to the future, we are grounded in our four cornerstones.

OUR CORE VALUES: Who we are

Progressive’s Core Values—Integrity, Golden Rule, Objectives, Excellence, and Profit—serve as the foundation for our culture. They represent our values, guide our decisions, and define how we conduct our business and interact with others.

•Integrity: We revere honesty and adhere to high ethical standards to gain the trust and confidence of our customers. We value transparency, encourage disclosing bad news, and welcome disagreement.

•Golden Rule: We value and respect our differences, act with kindness and caring, and treat others as they want to be treated.

•Objectives: We set ambitious goals and evaluate our performance by measuring what we achieve and how we achieve it. We’re committed to an inclusive and equitable workplace where rewards and promotion are based on results and ability.

•Excellence: We strive to meet or exceed the expectations of our teammates, customers, partners, and investors by continuously improving and finding new ways to meet their needs.

•Profit: We have a responsibility to ourselves, our customers, agents, and investors to be a profitable and enduring company by offering products and services consumers value.

OUR PURPOSE: Why we’re here

Progressive exists to help people move forward and live fully.

OUR VISION: Where we’re headed

Our Vision is to become consumers’, agents’, and business owners’ #1 destination for insurance and other financial needs.

OUR STRATEGY: How we’ll get there

We will achieve our vision through four Strategic Pillars: 1) People and Culture; 2) Broad Needs of our Customers; 3) Leading Brand; and 4) Competitive Prices.

2023 BUSINESS PERFORMANCE HIGHLIGHTS

As a property-casualty insurance company, we have earnings streams from both underwriting activity and investment activity. During 2023, we wrote $10.5 billion more in net premiums and added 2.3 million policies in force, compared to 2022, to end the year at $61.6 billion in net premiums written and 29.7 million policies in force. Despite the uncertainty and challenges we faced head on in 2023, we ended the year with an underwriting profit margin of 5.1% (exceeding our companywide profitability target of 4%), or $3.0 billion of pretax underwriting profit, compared to 4.2%, or $2.1 billion, for 2022. The increase over the prior year was primarily driven by significant rate increases, decreased advertising spend, and other non-rate actions taken to focus on profitable growth, partially offset by higher loss severity and unfavorable prior-year development.

Our fixed-maturity securities, which comprised 91.5% of our investment portfolio at fair value as of December 31, 2023, contributed to the $1.9 billion of recurring investment income earned in 2023, with fixed-maturity securities contributing a nearly 60% increase from the prior year, reflecting increases in interest rates and growth in the portfolio. During 2023, the changes in the market value of our fixed-maturity securities, which are a component of comprehensive income, increased $1.2 billion, after tax, due to lower interest rates and tighter credit spreads. The change in value of our equity and hybrid securities, which are reported as a component of our net income, increased by $1.9 billion during the year, and reflected general market conditions. For the year

ended December 31, 2023, our fully taxable equivalent total return on our investment portfolio was 6.3%.

During 2023, we declared aggregate dividends of $1.15 per common share to our shareholders, including our $0.75 per common share annual dividend and our $0.10 per common share quarterly dividends, and repurchased 1.0 million of our common shares at an average cost of $140.97 per common share. We ended 2023 with $27.2 billion of total capital and a debt-to-total capital ratio of 25.4%.

Following are a few key performance metrics for 2023:

| | | | | |

| Net premiums written growth | 20 | % |

| Policies in force growth | 9 | % |

| Combined ratio | 94.9 |

| Underwriting profit margin | 5.1 | % |

| Returns on average common shareholders’ equity: | |

| Net income | 22.9 | % |

| Comprehensive income | 30.0 | % |

| Net income | $3.9 billion |

| Net income per common share | $6.58 |

| Declared common shareholder dividends | $0.7 billion |

| Repurchased common shares | $0.1 billion |

We encourage you to review our Annual Report to Shareholders for additional information on our 2023 performance and our financial results.

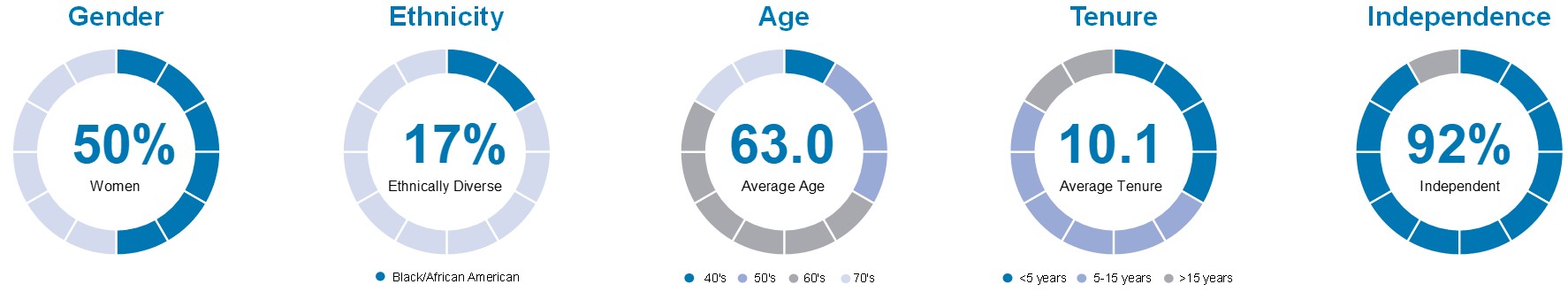

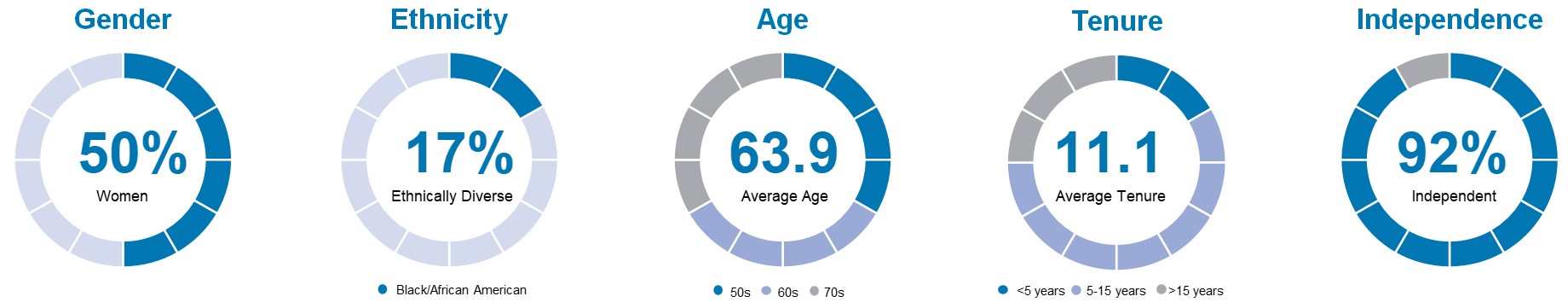

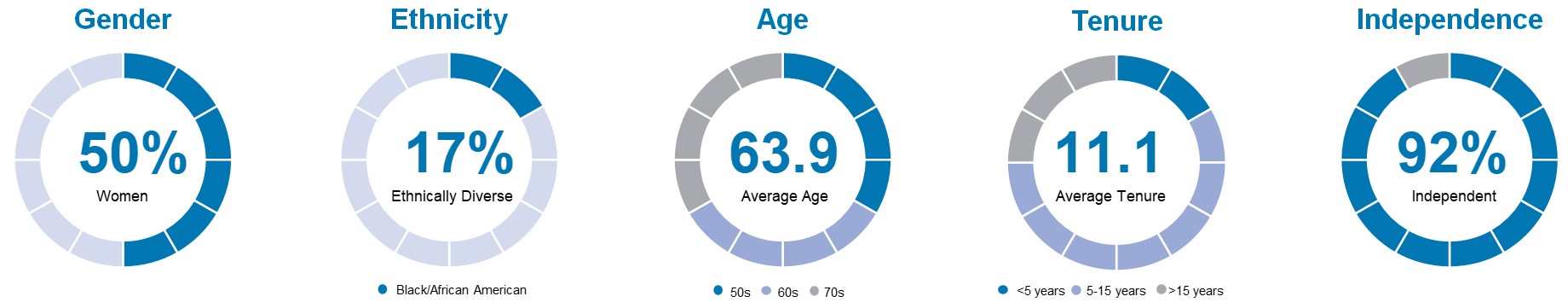

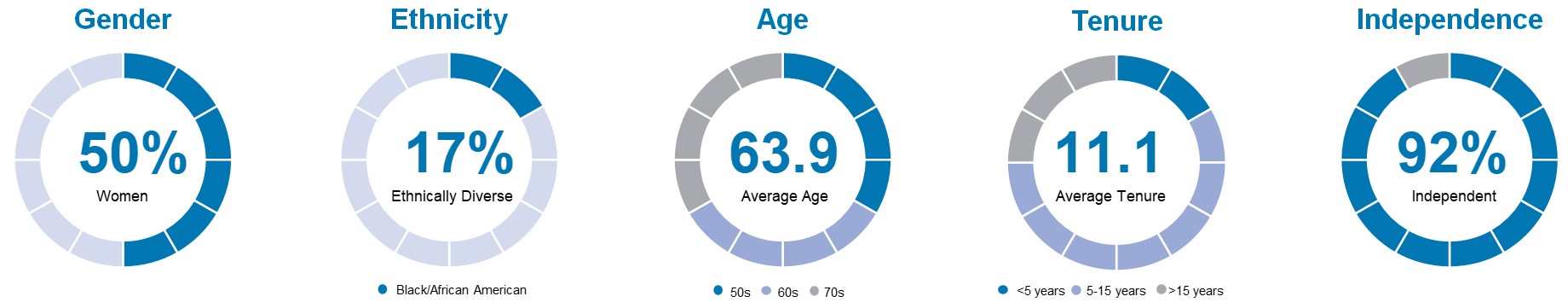

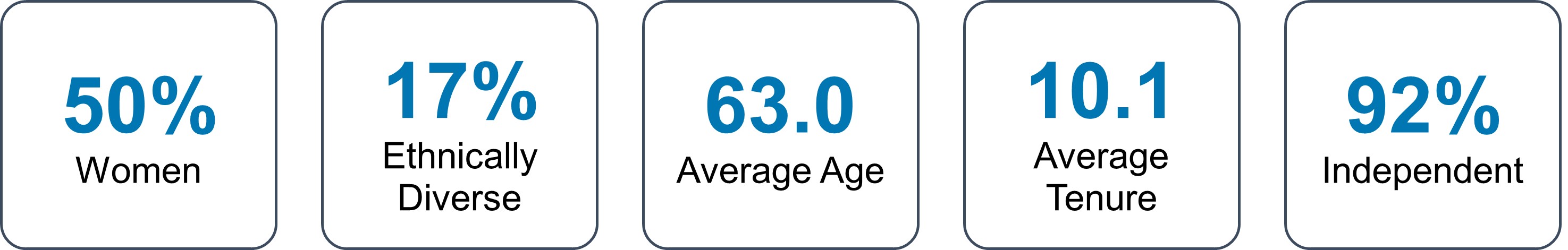

NOMINEES FOR DIRECTOR

The Board has nominated 12 directors, 11 of whom are current directors and oneeach of whom is a new nominee,current director, with a broad and complementary set of skills, experiences, backgrounds, and perspectives.

Diversity

Skills and Experiences

CORPORATE GOVERNANCE HIGHLIGHTS

Corporate Governance Practices

We are committed to meeting high standards of ethical behavior, corporate governance, and business conduct. Some of our corporate governance practices include: | | | | | | | | | | | | | | | | | | | | | | | |

| Effective Structure and Composition | | Additional Practices and Policies | | Shareholder Rights |

| ✔ | Independent, experienced Chairperson | | ✔ | Robust director stock ownership guidelines | | ✔ | Single class voting |

| ✔ | Independent committee leadership and strong independent committee membership | | ✔ | Established Board and committee risk oversight practices | | ✔ | Annual election of all directors |

| ✔ | A diverse and highly qualified Board | | ✔ | Board technology/cybersecurity expertise and oversight | | ✔ | Majority voting in uncontested director elections |

| ✔ | Five new directors and one new nominee in the last six years (including four current directors), four of whichwhom are women and two of whom are ethnically diverse | | ✔ | EnvironmentalESG (including climate change), social, and governance (ESG) oversight and reporting | | ✔ | Proxy access available |

| ✔ | Mandatory director retirement policy (no exemptions or waivers within the past three years) | | ✔ | Diversity, equity, and inclusion (DEI) oversight and reporting | | ✔ | No poison pill |

| ✔ | Independent directors meet regularly without management | | ✔ | Ongoing director education | | | |

| ✔ | Restrictions limiting the number of public company boards on which a director may serve | | ✔ | Annual Board and committee evaluation process | | | |

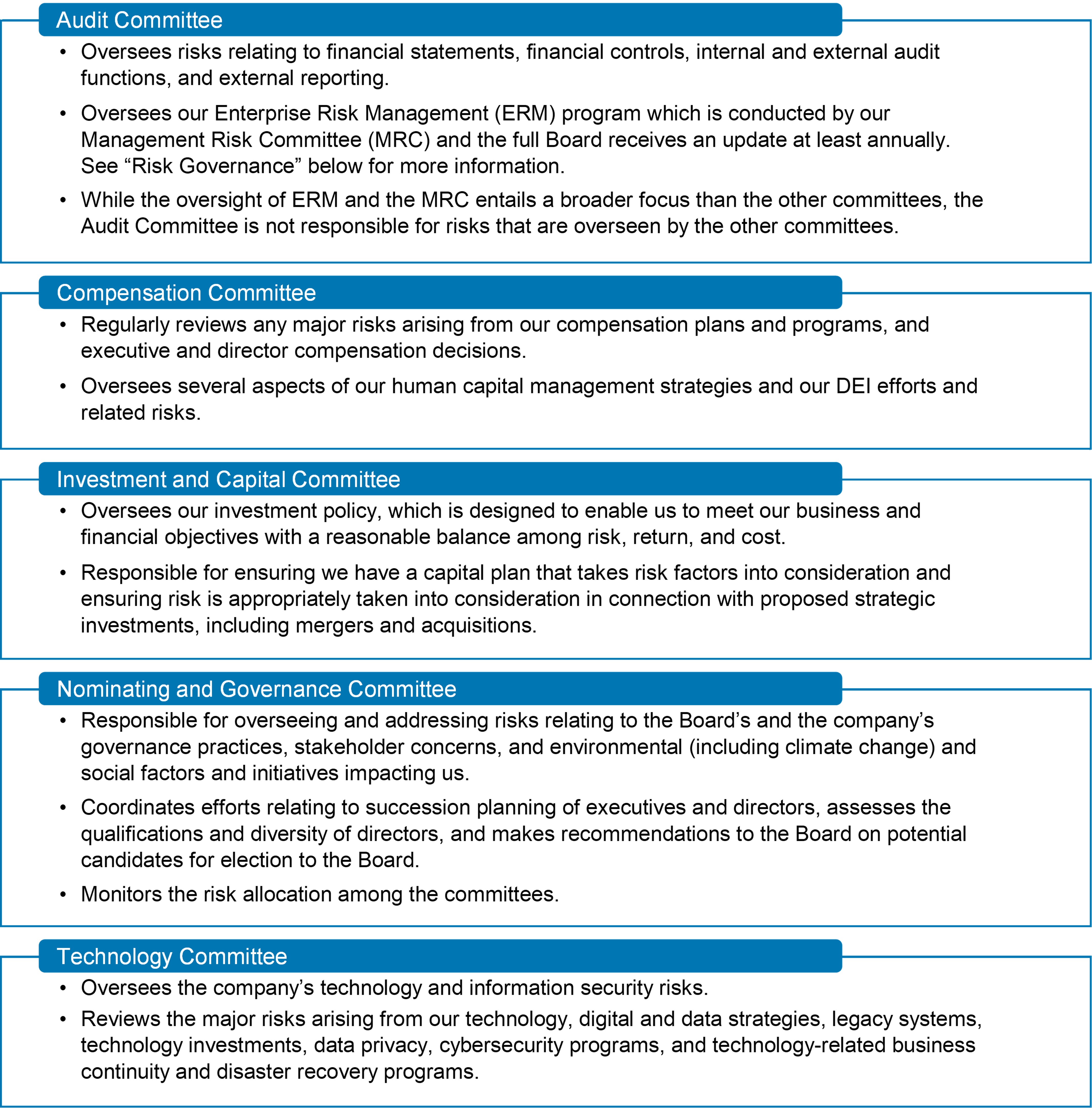

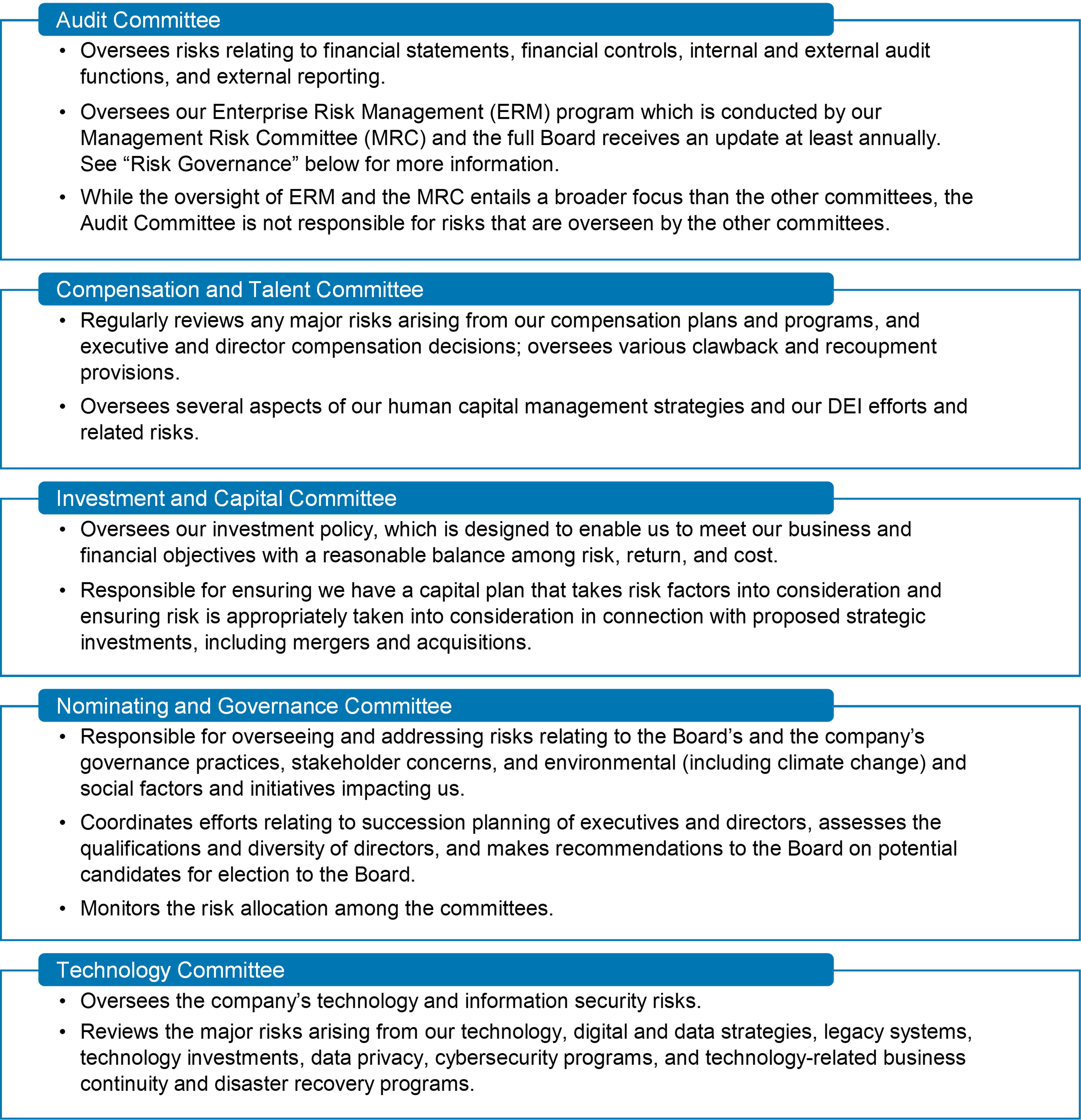

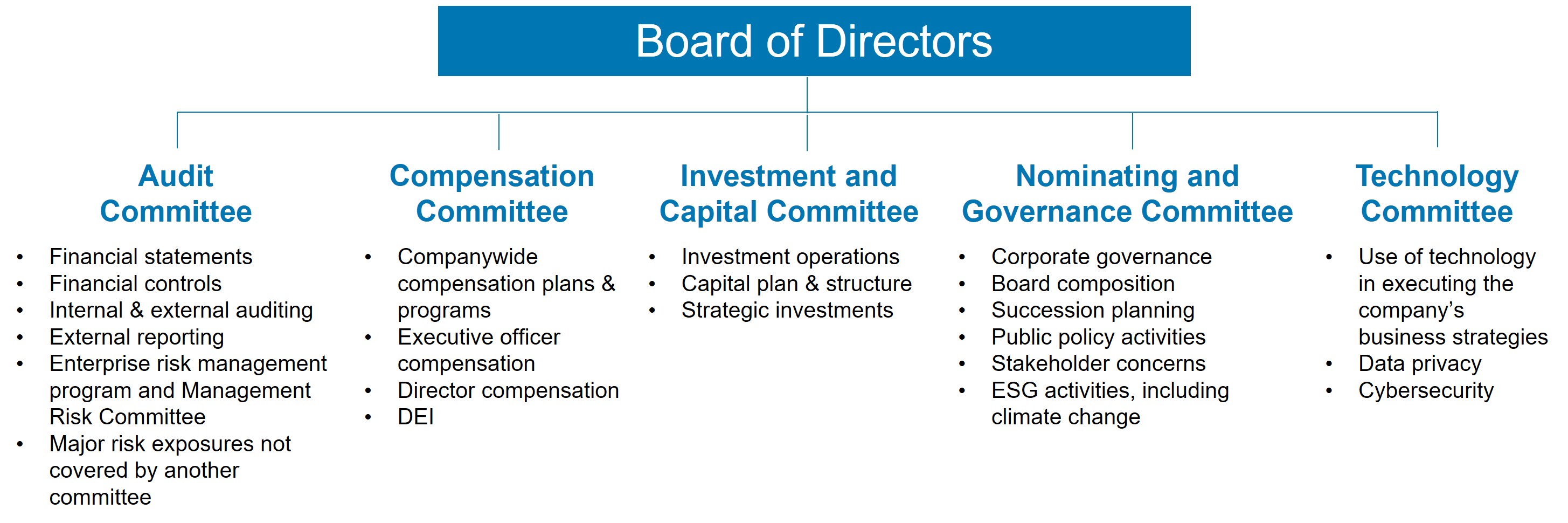

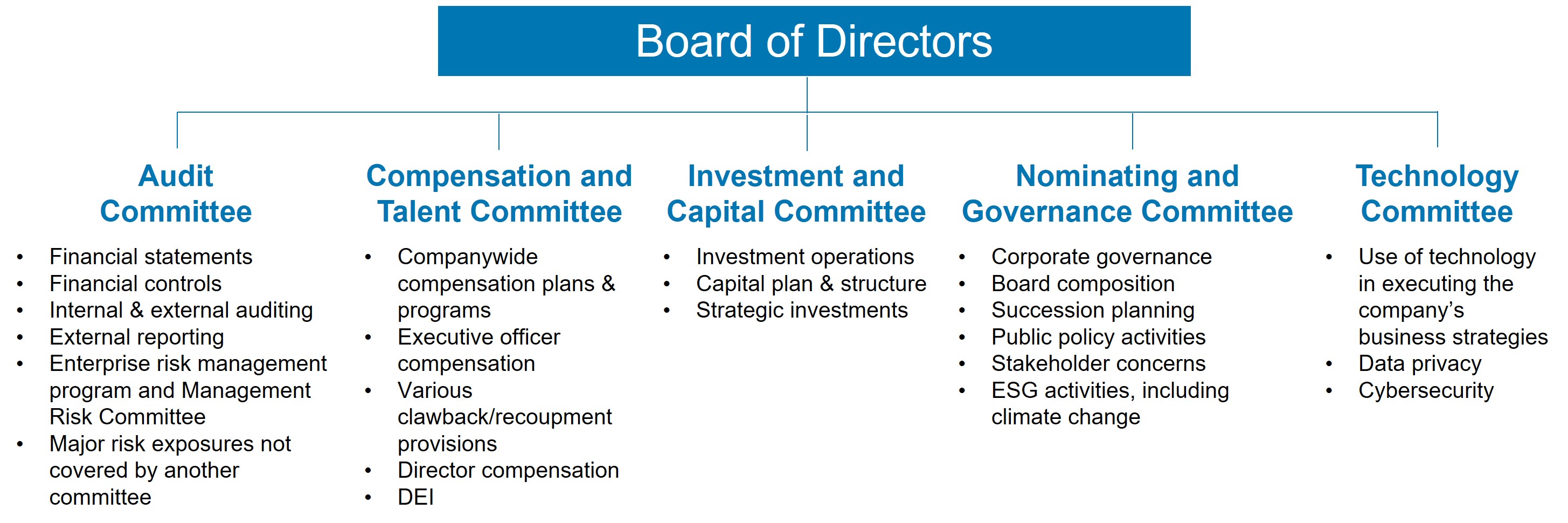

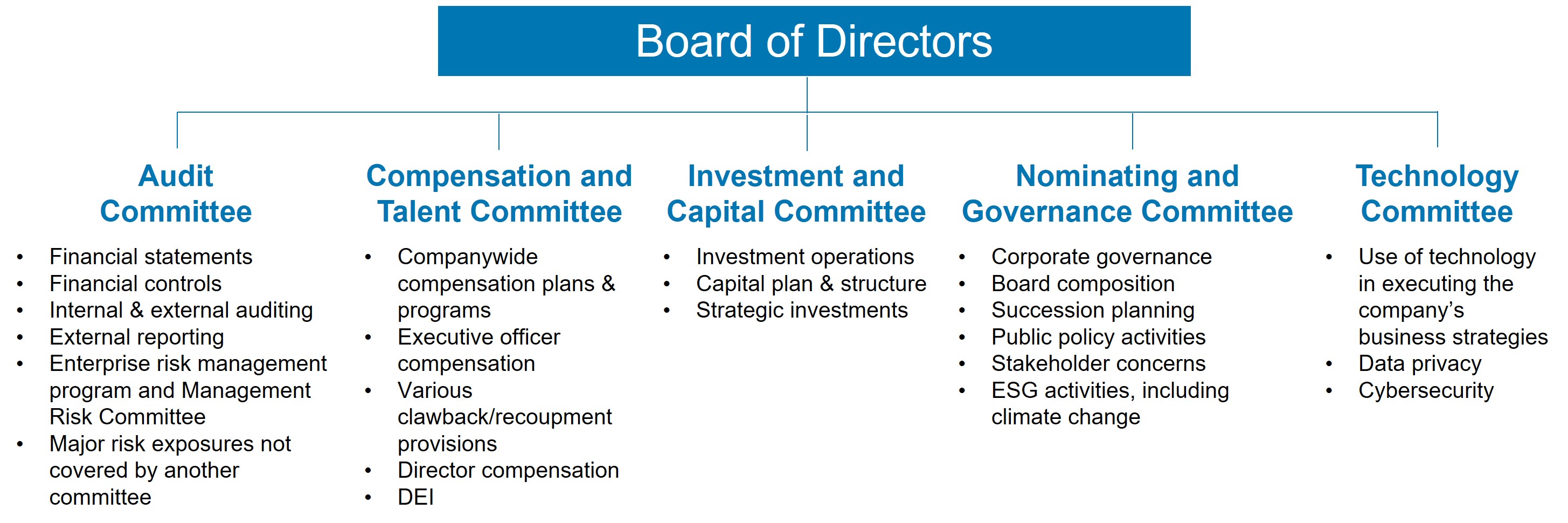

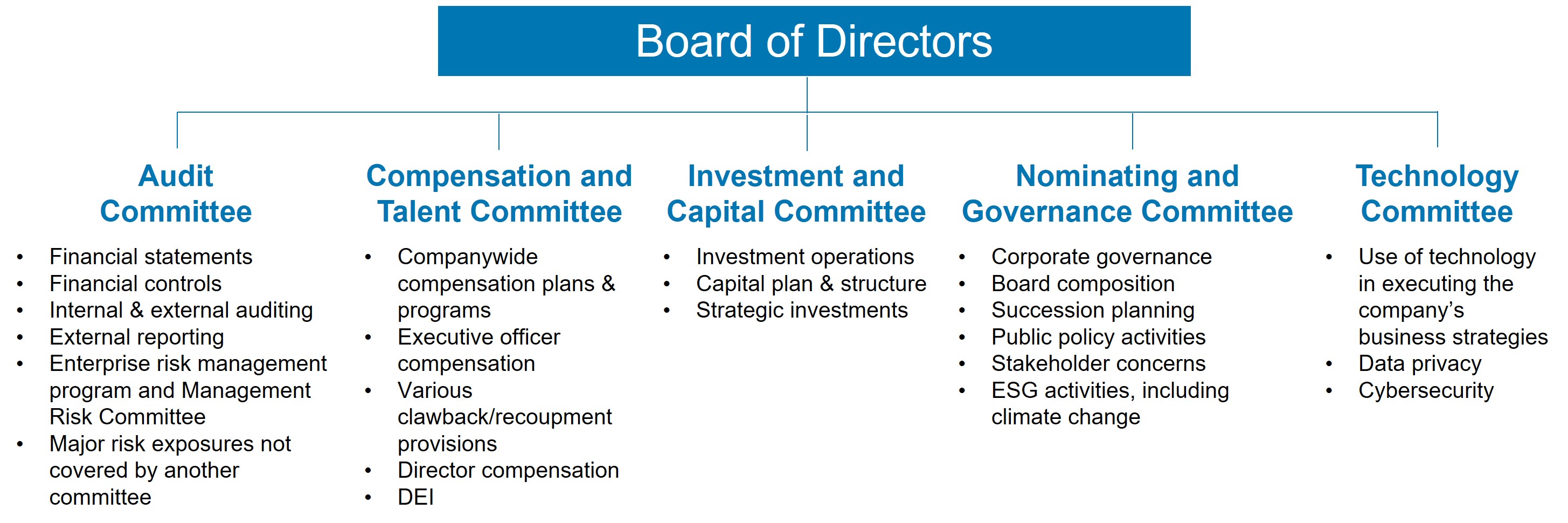

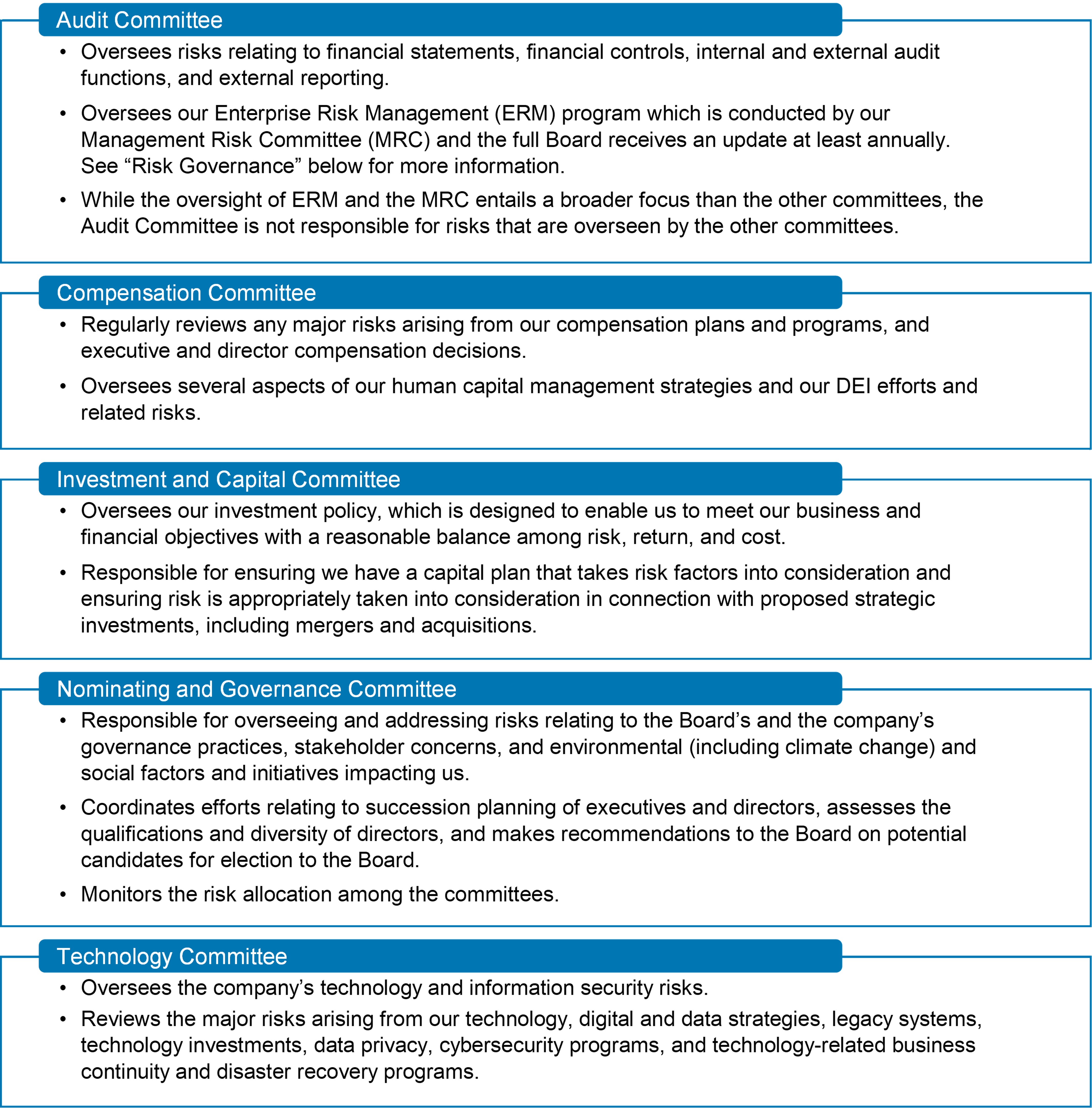

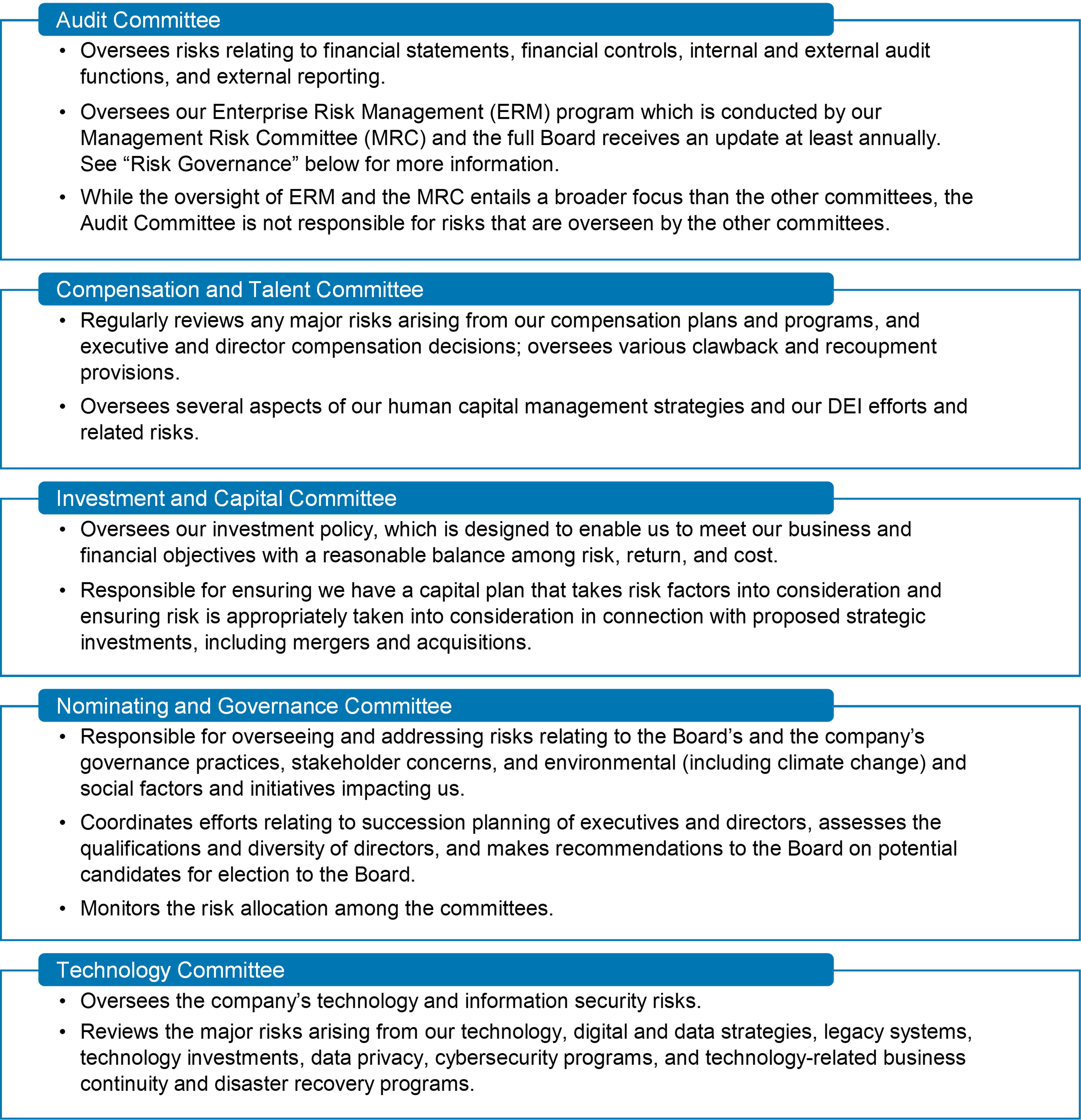

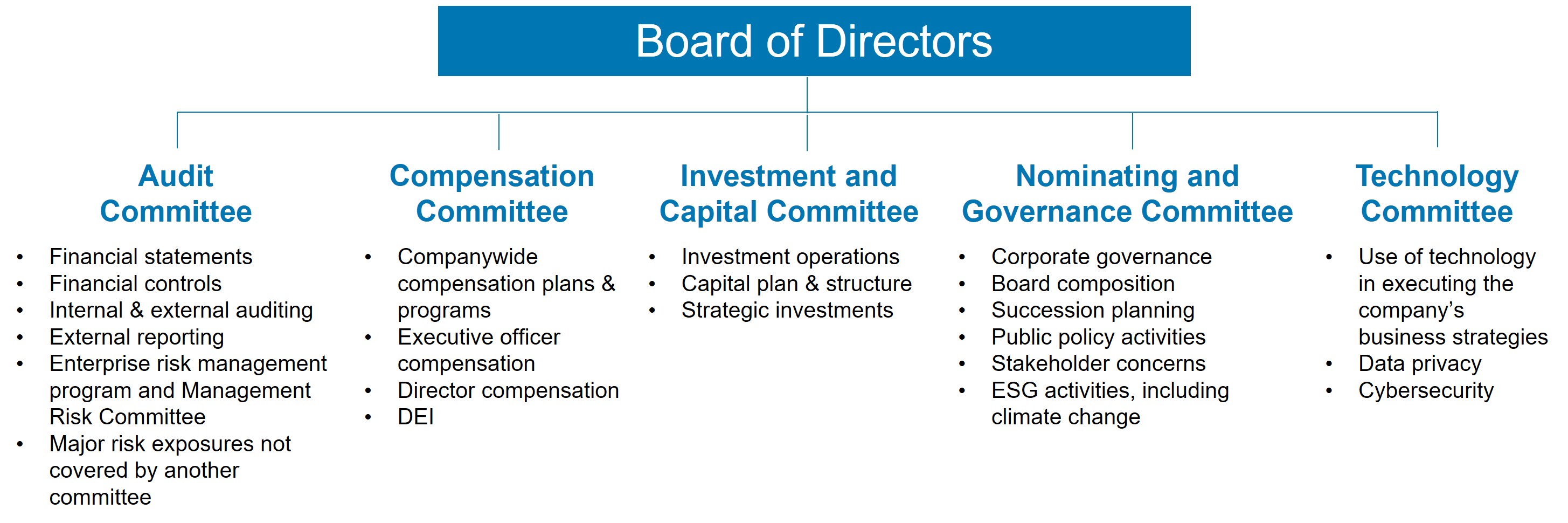

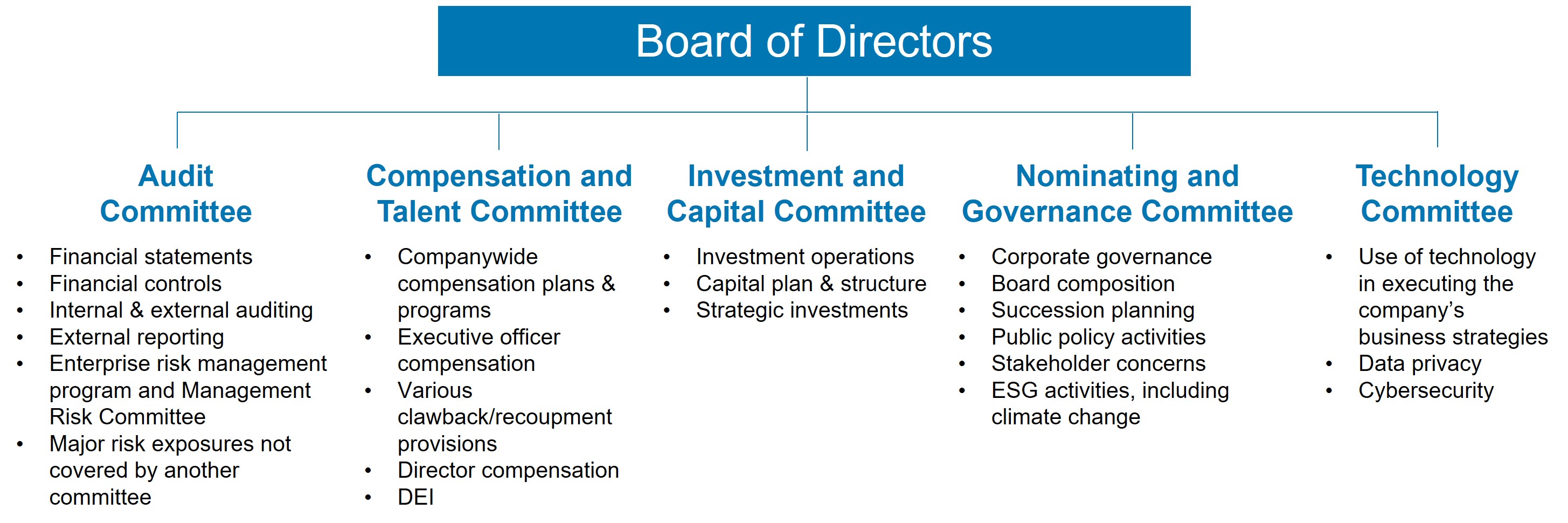

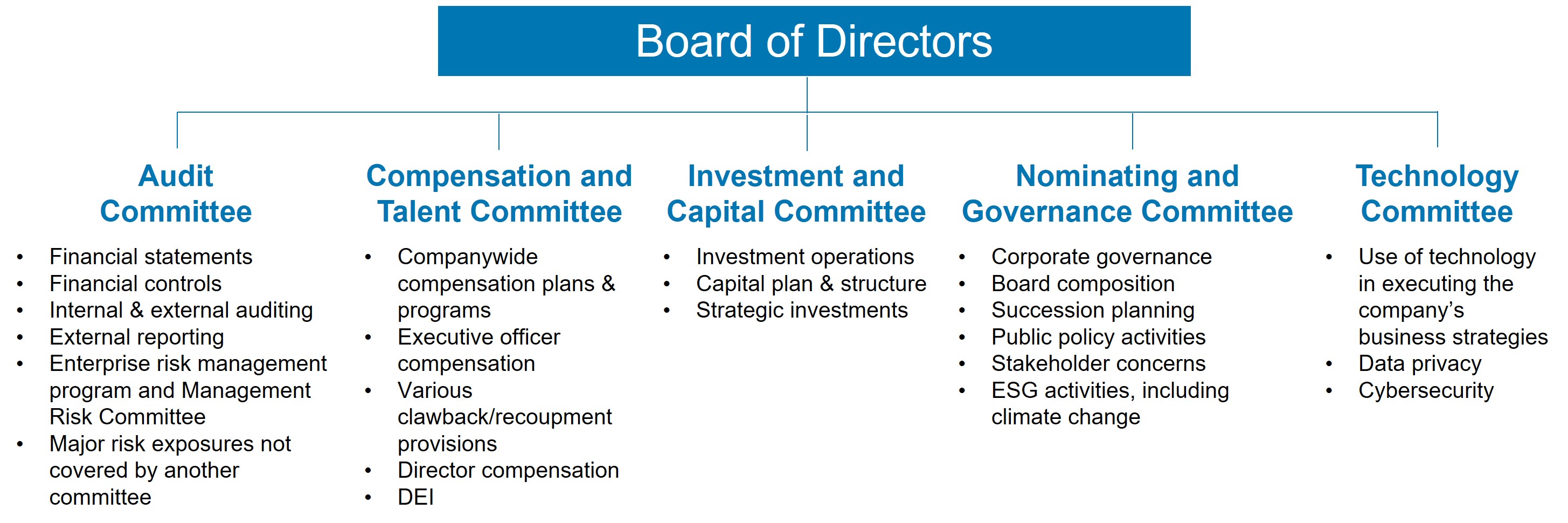

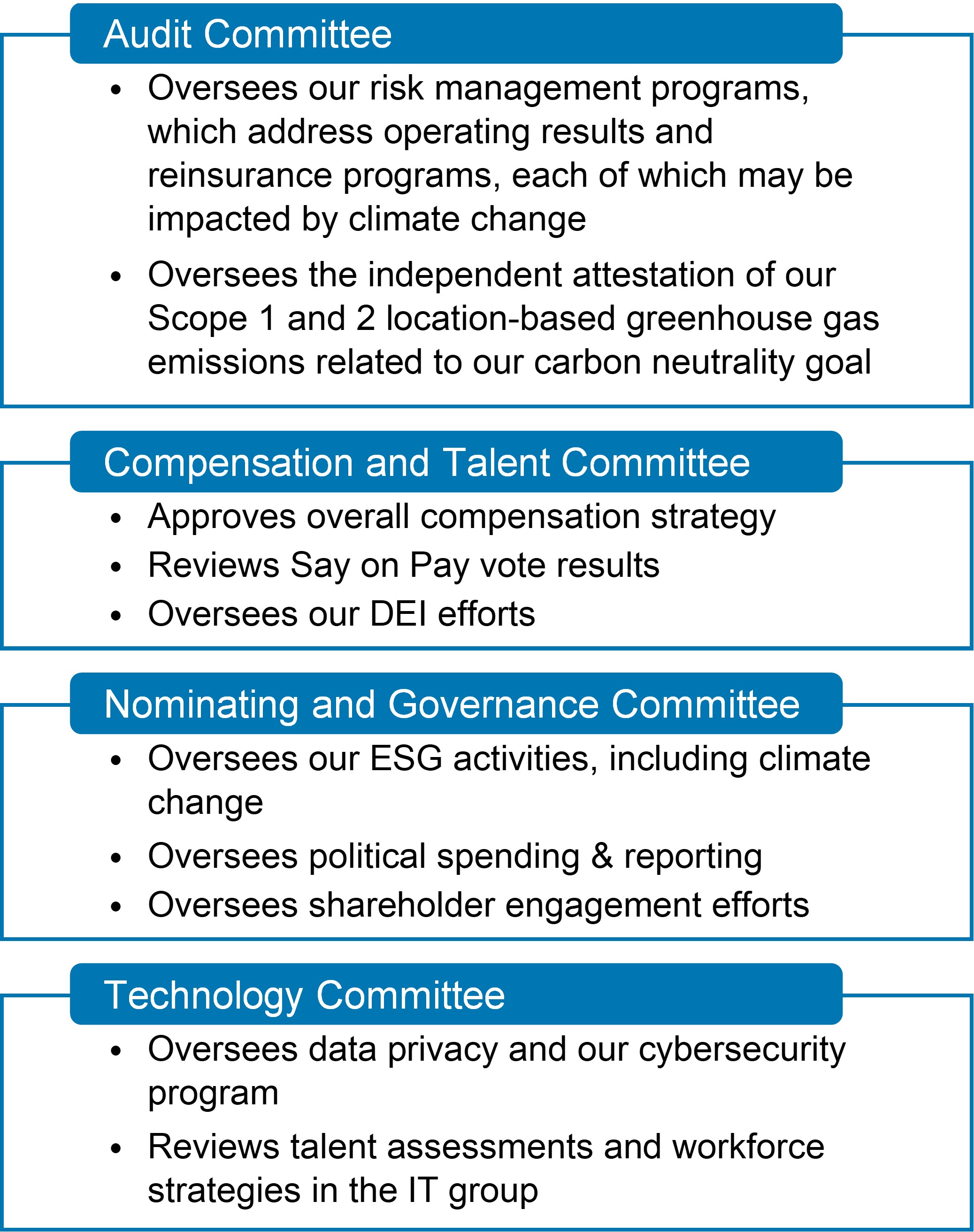

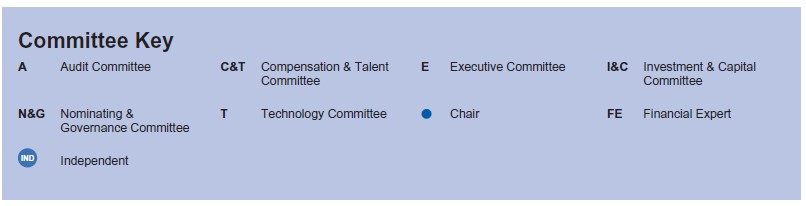

Board Risk Oversight

The Board is ultimately responsible for overseeing our risk profile and risk management processes. To facilitate these responsibilities, the Board assigns certain risk oversight responsibilities to each of its main committees through each committee’s charter. The committees continue to undertake the increasingly detailed oversight work for which they are responsible, to interact with and oversee management, and to report back significant matters to the full Board. A more detailed discussion of this oversight function is contained in the “Board Risk Oversight” section of this Proxy Statement.

SUSTAINABILITY AND ESG HIGHLIGHTS

Sustainability and ESG initiatives have been an integral part of the company’s business. Our Core Values (Integrity, Golden Rule, Excellence, Objectives, and Profit), first introduced in 1987, are a cornerstone of our business and, as such, are the tenets of sustainabilitythese initiatives and have evolved naturally as we work to not only grow our business, but also to support our customers, community, and employees.

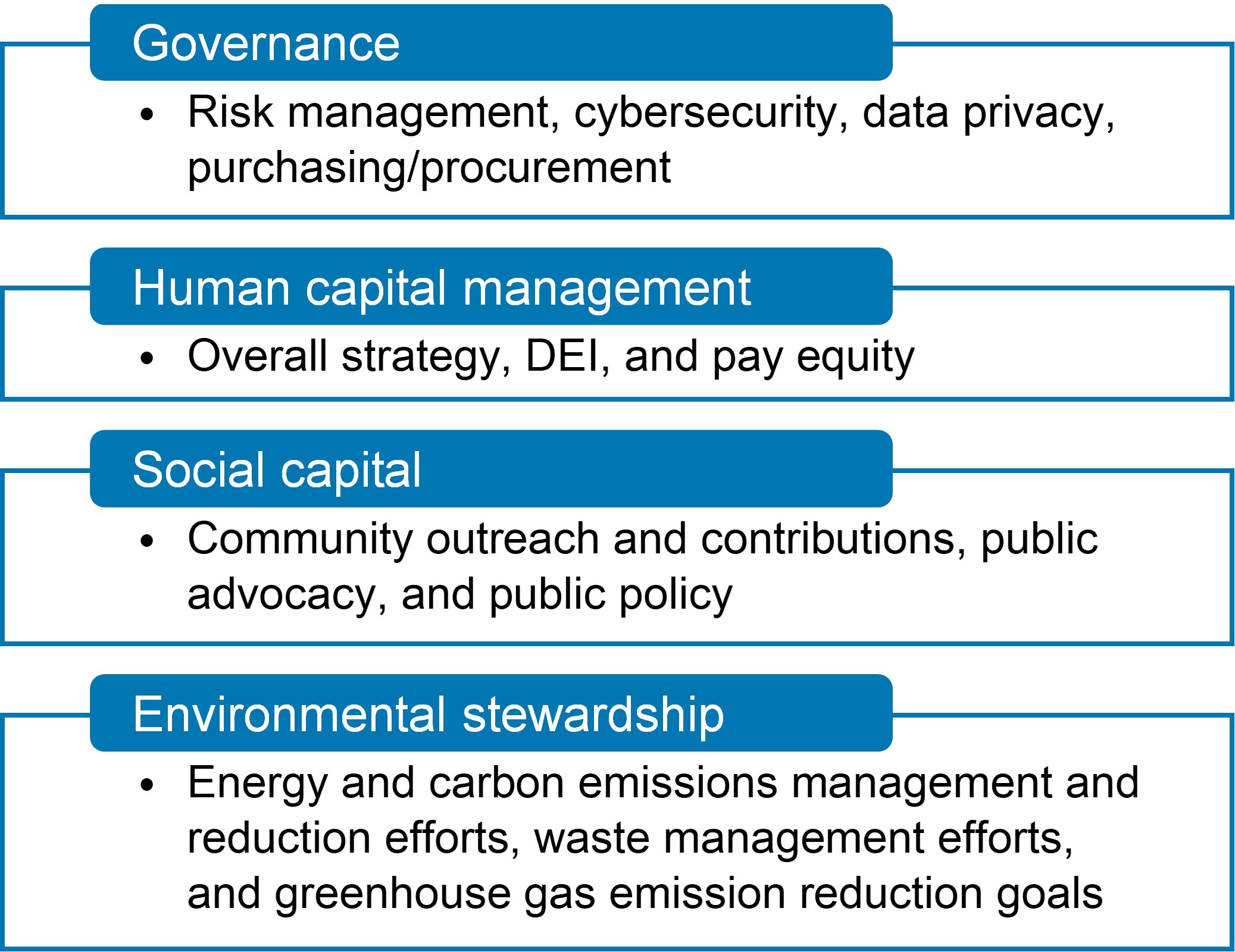

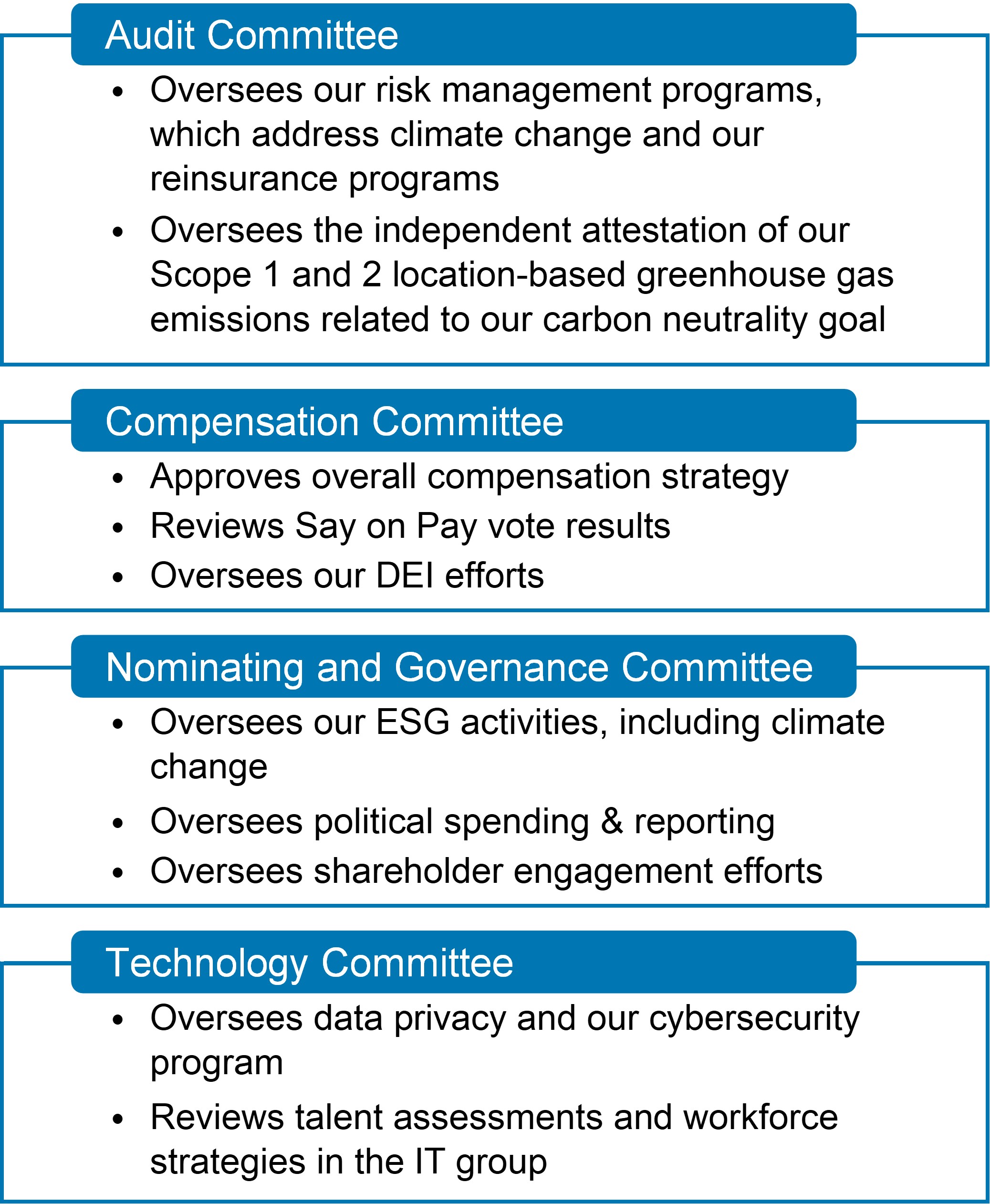

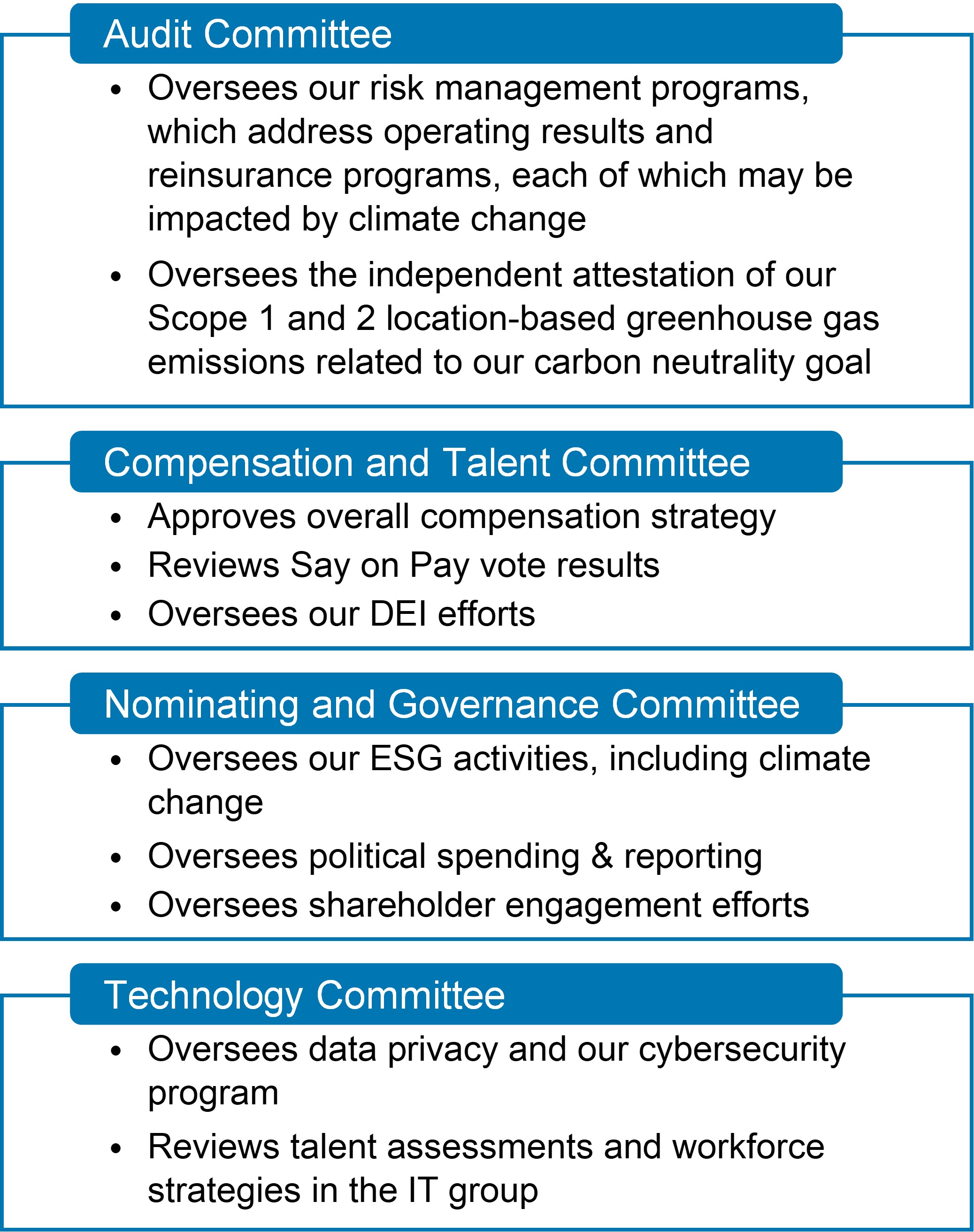

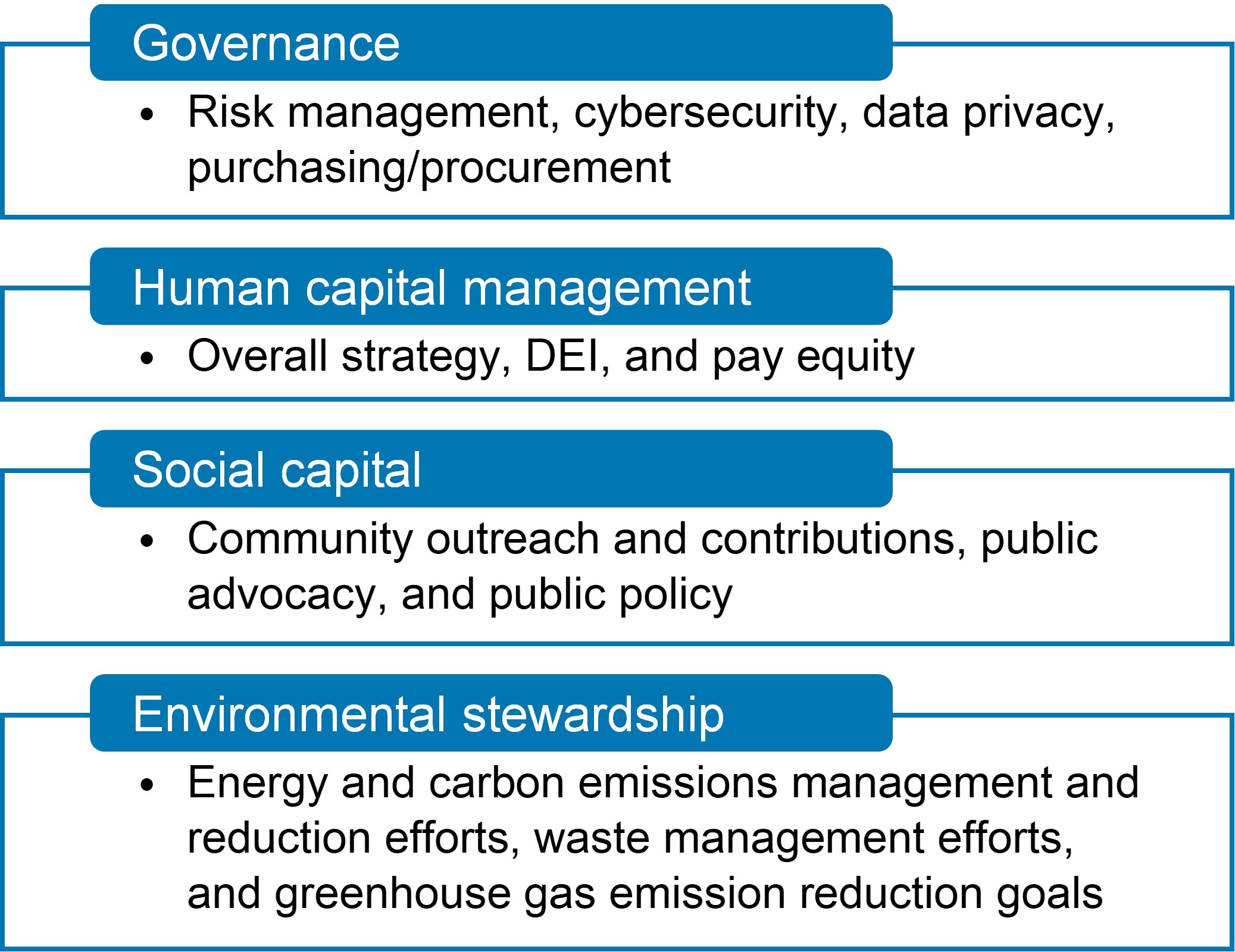

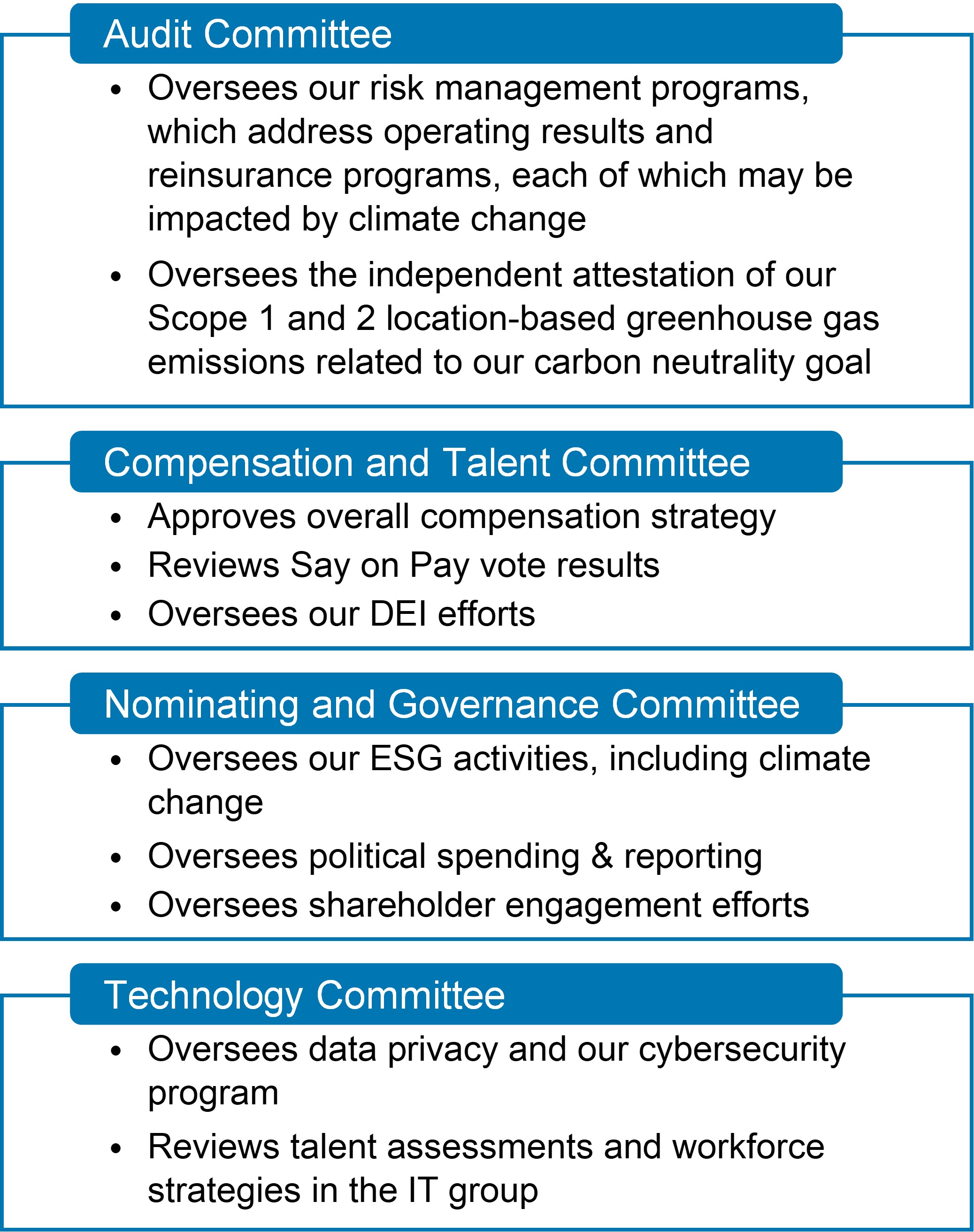

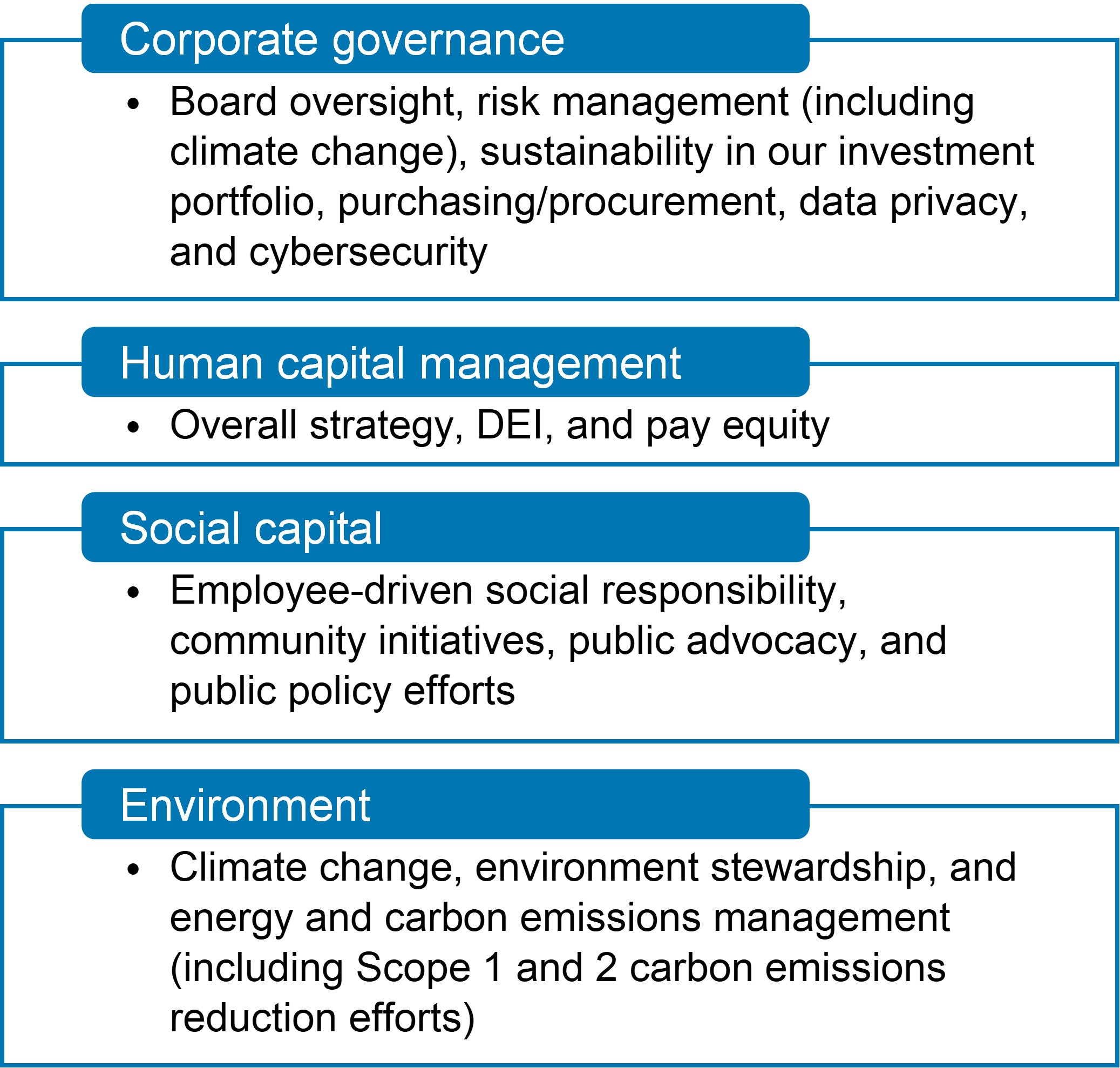

The Board’s Approach

The Board and its committees oversee the assessment and management of various sustainability and ESG matters. In their oversight role, our directors ask questions, probe our thinking, provide strategic input, and give guidance informed by their diverse skills and experiences. The following chart highlights some of our Board’s involvement with these matters.

Our Sustainability EffortsNOMINEES FOR DIRECTOR

At Progressive, we aim to takeThe Board has nominated 12 directors, each of whom is a forward-looking approach to everything we do, from the products we offer to the way we interactcurrent director, with the world around us. We work to drive sustainable change for our shareholders, employees, agents, communities,a broad and the millionscomplementary set of customers who trust us to protect what is important to them. As our efforts evolve with the world around us, we expect to adapt our sustainability reporting.skills, experiences, backgrounds, and perspectives.

Our most recent Corporate Sustainability Report was prepared with guidance from the NominatingDiversity

Skills and Governance Committee, our executive leadership, and various subject matter experts. The report was informed by elements from various reportingExperiences

CORPORATE GOVERNANCE HIGHLIGHTS

Corporate Governance Practices

We are committed to meeting high standards of ethical behavior, corporate governance, and business conduct. Some of our corporate governance practices include: | | | | | | | | | | | | | | | | | | | | | | | |

| Effective Structure and Composition | | Additional Practices and Policies | | Shareholder Rights |

| ✔ | Independent, experienced Chairperson | | ✔ | Robust director stock ownership guidelines | | ✔ | Single class voting |

| ✔ | Independent committee leadership and strong independent committee membership | | ✔ | Established Board and committee risk oversight practices | | ✔ | Annual election of all directors |

| ✔ | A diverse and highly qualified Board | | ✔ | Board technology/cybersecurity expertise and oversight | | ✔ | Majority voting in uncontested director elections |

| ✔ | Five new directors in the last six years (including four current directors), four of whom are women and two of whom are ethnically diverse | | ✔ | ESG (including climate change) oversight and reporting | | ✔ | Proxy access available |

| ✔ | Mandatory director retirement policy (no exemptions or waivers within the past three years) | | ✔ | Diversity, equity, and inclusion (DEI) oversight and reporting | | ✔ | No poison pill |

| ✔ | Independent directors meet regularly without management | | ✔ | Ongoing director education | | | |

| ✔ | Restrictions limiting the number of public company boards on which a director may serve | | ✔ | Annual Board and committee evaluation process | | | |

Board Risk Oversight

The Board is ultimately responsible for overseeing our risk profile and risk management processes. To facilitate these responsibilities, the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosure (TCFD), and includes indicesassigns certain risk oversight responsibilities to each of these reporting frameworks.its main committees through each committee’s charter. The committees continue to undertake the increasingly detailed oversight work for which they are responsible, to interact with and oversee management, and to report provides information regarding our philosophy and practices on a numberback significant matters to the full Board. A more detailed discussion of topics, including:

To review our most recent Corporate Sustainability Report, please visit our sustainability site at investors.progressive.com/sustainability-reports. The report and any other information onthis oversight function is contained in the sustainability site are not incorporated by reference in, and do not form part“Board Risk Oversight” section of this Proxy Statement or any other SEC filing.Statement.

| | |

Spotlight on Environmental Stewardship |

We continue to make increasing efforts to reduce carbon emissions and operate efficiently in all aspects of our business. We report our environmental efforts to inform our stakeholders of the efforts we are making, the initiatives and steps taken, and the forward movement on our commitments. We continue to advance our environmental stewardship efforts by seeking investments in green energy usage for our facilities, exploring opportunities to shift toward a lower-emissions vehicle fleet, and reducing paper correspondence with our customers. We believe that if we can yield positive environmental results from our business operations, we can create a sustainable business in line with our Core Values.

As we look forward to the future, we are excited to continue to be responsible environmental stewards. Recently we announced a goal of carbon neutrality by the end of 2025 for Scopes 1 and 2, which will help set the path to net-zero in the following decade. To enhance our accountability, we engaged an independent third party to provide limited assurance on our Scope 1 and Scope 2 location-based greenhouse gas emissions reporting.

|

HUMAN CAPITAL MANAGEMENTSUSTAINABILITY AND ESG HIGHLIGHTS

We believe thatSustainability and ESG initiatives have been an integral part of the company’s business. Our Core Values are a cornerstone of our people and our culture remain our most significant competitive advantage, and that having the right people working together in the right way is critical to driving our results, building our enduring business and, creating long-term shareholder value. Our culture is deeply rooted inas such, are the tenets of these initiatives and have evolved naturally as we work to not only grow our Core Values and is the foundation for our human capital management strategies to attract, retain, and motivate highly qualified employees.

Our People

We believe that our culture and continued success has enabled us to attract, engage, and retain highly talented people in diverse markets and from a broad range of backgrounds and experiences.

Attract and Hire We employ extensive recruiting practices with a goal of developing qualified and deep candidate pools and attracting candidates from both established and new sources. We believe that our recruitment efforts generally have enabled us to present diverse and high-potential pools of job candidates to our hiring managers. In turn, we train our hiring managers about identifying and avoiding unconscious biases they may have during the interview and selection process and the importance of employing individuals with different kinds of experiences and backgrounds. We believe these strategies collectively enhance our applicant pools and contribute to our continued success.

Engage and Retain We understand that engaged employees are more productive, provide better service to our customers and are more likely to stay with Progressive. Each year, we survey our people to measure their engagement. We use the results, along with other information, to evaluate our human capital strategies and the health of our culture.

Employee retention is an important part of our strategy. Promoting from within isbusiness, but also a key part of our strategy. Many of our leaders, including most current executive team members, joined Progressive in a more junior position and advanced to significant leadership positions within the organization.

Demographic Data We publish employee and manager demographic information on our website and update this data on an annual basis. We also disclose our consolidated EEO-1 data online.

As of December 31, 2022, we had about 55,100 employees, of which 59% were women and 39% were people of color. We also had over 1,000 senior leaders, of which 39% were women and 17% were people of color.

Supporting our People and Culture

We strive to support our employeescustomers, community, and employees.

The Board’s Approach

The Board and its committees oversee the assessment and management of various sustainability and ESG matters. In their oversight role, our directors ask questions, probe our thinking, provide strategic input, and give guidance informed by providing challenging work experiences, career opportunities, and a culture of learning. We are focused on coaching and development, which we believe promotes greater engagement in our business and improved individual performance.

Training and DevelopmentWe actively foster a learning culture and offer several leadership development programs, including our Multicultural Leadership Development Program. Moreover, our personal development strategy, “Own It,” encourages employees to take control of their career through team-building exercises, coaching techniques, and communication strategies. Available to new and tenured employees, our learning solutions are tailored to both individual contributors and leaders and cover a broad swath ofdiverse skills and competencies.

ERGs Over a decade ago, our first employee resource groups (ERGs) were created to help build communities for our employees with common backgrounds, life experiences, interests, and professional goals. In the time since their inception, our nine ERGs have grown in both influence and size with 43% of Progressive people belonging to at least one of theexperiences. The following ERGs as of December 31, 2022:

•Asian American Network

•Disabilities Awareness Network

•LGBTQ+ Network

•Military Network

•Network of Empowering Women

•Parent Connection

•Progressive African American Network

•Progressive Latin American Networking Association

•Young Professionals Network

Compensation and Benefits As part of employee compensation, nearly all Progressive people participate in our annual cash incentive program named Gainshare, which measures the growth and profitabilitychart highlights some of our insurance businesses. We believe Gainshare contributes to the cooperative and collaborative way we work together and, in part, defines our culture. We also monitor overall pay equity among employeesBoard’s involvement with similar performance, experience, and job responsibilities, and publish the results annually on our DEI website. Additionally, our employee benefits are intended to be competitive and to support the needs of our people and their families. We invest in physical, emotional, and financial health of Progressive people by providing a broad range of benefits.these matters.

Diversity, Equity, and Inclusion

We believe that in order to be consumers’, agents’, and business owners’ number one destination for insurance and other financial needs, we need to anticipate and understand the needs of our customers. Therefore, we seek to be diverse in our employee demographics, experiences, and perspectives.

Our commitment to diversity starts at the top with our highly skilled and diverse Board, as discussed above. We are one of the few public companies with a female CEO, as well as a female independent Board Chairperson. Our DEI efforts are overseen by our Compensation Committee on behalf of the entire Board, and those efforts are implemented at all levels of the organization.

Our efforts focus on four primary objectives, which have been in place for several years:

•To maintain a fair and inclusive work environment

•To reflect the customers we serve

•For our leaders to reflect the people they lead

•To contribute to our communities

In line with this focus, in 2020 we introduced an ambitious goal to double the representation of people of color in senior leadership from 10% to 20% by the end of 2025. During 2022, we increased this senior leadership representation from 16% to 17%, more than halfway to our goal.

We support DEI awareness among our employees in several ways. This includes hosting an annual weeklong event focused on diversity and inclusion, where employees have the opportunity to attend webinars and panel discussions, take part in group activities, listen to podcasts featuring Progressive employees, and more. We also have DEI leadership job objectives for our executive team and managers aimed at fostering a diverse and inclusive workplace.

Moreover, we support efforts to contribute to our communities, through our Keys to Progress® programs (which include providing vehicles to veterans and furnishing homes for individuals emerging from homelessness), our various education and engagement efforts, and our financial contributions to various community organizations.

For over 20 years, we have also contributed to The Progressive Insurance Foundation, which provided matching funds to eligible 501(c)(3) charitable organizations to which employees contributed. To more broadly represent our employees and their communities, in 2020, The Progressive Insurance Foundation began funding national charitable organizations identified by our Employee Resource Groups and, beginning mid-2022, through the Name Your Cause program each employee can recommend that the Foundation give a minimum of $100 to a

charity of their choice, without requiring an out-of-pocket donation from the employee. This is the Foundation’s way of supporting more causes and reaching more communities across the country where Progressive’s people, and its customers, live and work.

We know we still have much more work to do, but we are committed to these efforts. To learn more visit our DEI site at progressive.com/about/diversity-and-inclusion. The information on the DEI site is not incorporated by reference in, and does not form part of, this Proxy Statement or any other SEC filing.

See “Compensation Discussion and Analysis – The Role of Diversity, Equity, and Inclusion” for more information.

2022 BUSINESS PERFORMANCE HIGHLIGHTS

As a property-casualty insurance company, we have earnings streams from both underwriting activity and investment activity. During 2022, we wrote $4.7 billion more in net premiums, compared to 2021, and added 0.9 million policies in force to end the year at $51.1 billion in net premiums written and 27.4 million policies in force. Despite the business challenges during 2021 that continued into 2022, we recognized an underwriting profit margin of 4.2%, or $2.1 billion of pretax underwriting profit. While our underwriting margin decreased 0.5 points in 2022, primarily driven by higher catastrophe losses and higher loss severity, partially offset by significant rate increases and lower frequency, it exceeded our companywide profitability target of 4% for 2022.

Changes in the value of our equity securities, which represented 7.5% of the fair value of our investment portfolio at December 31, 2022, are reflected in net income. Consistent with market trends and decreases in market valuations of our equity security portfolio, in 2022, net income included total net realized losses on securities of $1.9 billion and our fully taxable equivalent total return was (7.8)%.

During 2022, we returned aggregate dividends of $0.40 per common share to our shareholders, representing our $0.10 per common share quarterly dividends, and repurchased 0.9 million of our common shares at an average cost of $115.44 per common share. The Board decided not to declare an annual-variable dividend for 2022 after assessing our capital position, existing capital resources, and expected future capital needs, including the then current market conditions that could present opportunities for further growth in 2023. We ended 2022 with $22.3 billion of total capital and a debt-to-total capital ratio of 28.7%.

Following are a few key performance metrics for 2022:

| | | | | |

Net premiums written growth | 10 | % |

Policies in force growth | 3 | % |

Combined ratio | 95.8 |

Underwriting profit margin | 4.2 | % |

Returns on average common shareholders’ equity: | |

Net income | 4.4 | % |

Comprehensive income (loss) | (13.5) | % |

Net income | $0.7 billion |

Net income per common share | $1.18 |

Declared common shareholder dividends | $0.2 billion |

Repurchased common shares | $0.1 billion |

We encourage you to review our Annual Report to Shareholders for additional information on our 2022 performance and our financial results.

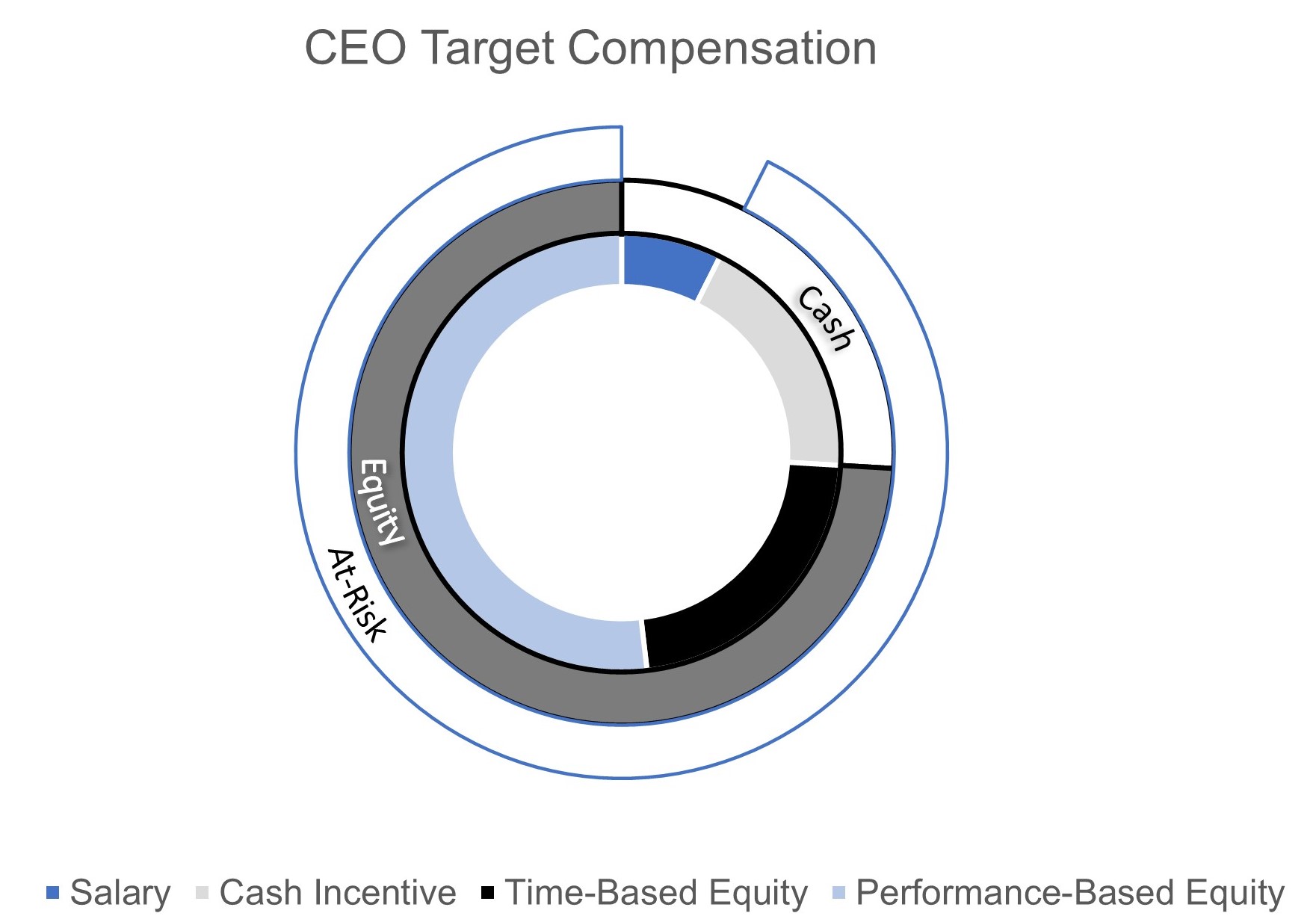

EXECUTIVE COMPENSATION HIGHLIGHTS

We believe that our executive compensation program, including the closely aligned companywide annual cash incentive program we call Gainshare, has been a critical component of our strong operating results and, in turn, shareholder returns in recent years. We believe this program’s structure supports a strong pay-for-performance linkage. Our Gainshare program has paid out an average of 164% of target over the last five-year period and, for 2022, paid out at 86% of target, which reflected the challenging year in terms of both profitability and growth. Regarding our performance-based equity awards, we have grown faster than the market for the business lines we measure, resulting in the vesting of these awards above targets in each of the past five years.

Our executive compensation program is overseen by the Compensation Committee of the Board. Compensation Committee decisions are made after considering third-party compensation data for comparable companies, internal analyses, and recommendations presented by management. The executive compensation decisions for executive officers generally represent the culmination of extensive analysis and discussion, which typically take place over the course of multiple committee meetings and in meetings between the committee and management, including our CEO, our Chief Human Resources Officer, members of our compensation and law departments, and sometimes compensation consultants.

Our executive compensation program has a number of important structural features and guiding policies, including following these executive compensation practices:

| | | | | | | | | | | |

What We DO Have | | |

✔ | Independent Compensation Committee that establishes compensation for executive officers | |

| |

✔ | Heavy weighting of at-risk “pay for performance” compensation | |

| |

✔ | Typically below market base salary with opportunity to exceed median with strong performance | |

| |

✔ | Stock ownership guidelines | | |

✔ | Clawback/forfeiture provisions (including restatements and reputational harm) | |

| |

✔ | DEI-related goal embedded into each executive officer’s job objectives, which factors into setting overall annual target compensation | |

| |

| |

| | | | | | | | |

What We DON’T Have | |

✘ | Employment agreements | |

| | |

✘ | Guaranteed salary increases or bonuses | |

| | |

✘ | Hedging/pledging of our stock | |

| | |

✘ | “Timing” of equity awards | |

| | |

✘ | Single-trigger change in control benefits | |

| | |

✘ | Pension plan or supplemental retirement benefits provided to executives |

|

| | |

STAKEHOLDER ENGAGEMENT

We seek to provide transparency into our business, our performance, our strategic priorities, our governance practices, and how our Core Values guide our decisions and support our culture. We share information with our stakeholders in a variety of ways, including monthly earnings releases, quarterly earnings calls, annual shareholder meetings, quarterly letters from our CEO, and annual letters from our Chairperson of the Board.

We recognize the value in maintaining open lines of communication with our stakeholders and engage with our stakeholders throughout the year to:

•provide visibility and transparency into our business, our performance, and our corporate governance, ESG, and compensation practices;

•discuss with our investors the issues that are important to them, hear their expectations for us, and share our views; and

•assess emerging issues that may affect our business, inform our decision making, and enhance our corporate disclosures.

ITEM 1: ELECTION OF DIRECTORS

Our Code of Regulations establishes the number of directors at no fewer than five and no more than 13. The number of directors has been fixed at 12, and there are currently 12 directors on the Board. As stated in our Corporate Governance Guidelines, the Board may change the size of the Board from time to time depending on its needs and the availability of qualified candidates. In this proposal, we are asking shareholders to elect as directors the 12 nominees named below.

Each director elected will serve a one-year term and until their successor is duly elected. If, by reason of death or other unexpected occurrence, any one or more of the nominees named below is not available for election, the proxies will be voted for substitute nominee(s), if any, as the Board may propose.

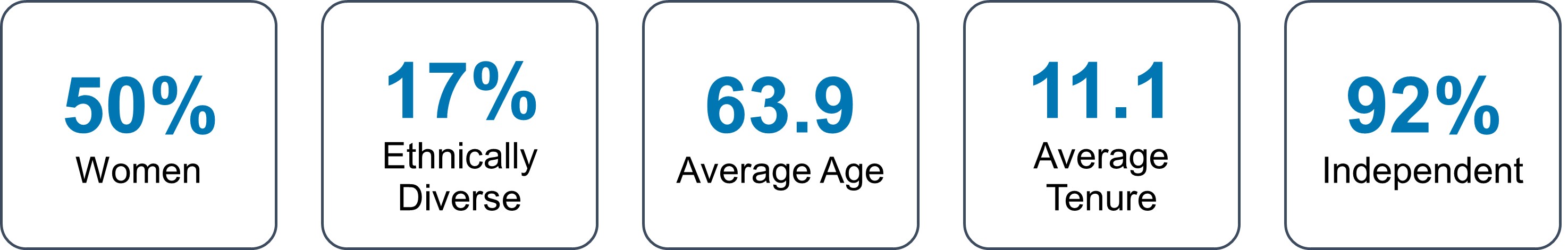

NOMINEES FOR DIRECTOR

The Board has nominated 12 directors, each of whom is a current director, with a broad and complementary set of skills, experiences, backgrounds, and perspectives.

Diversity

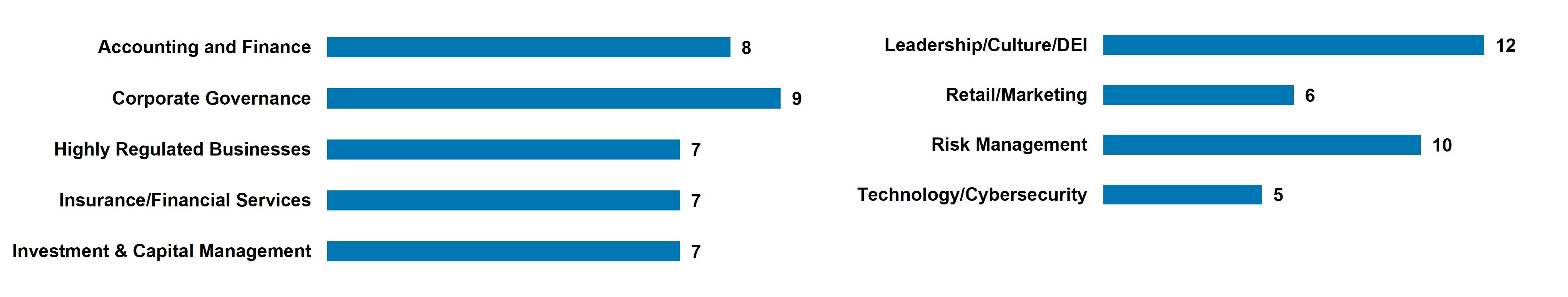

Skills and Experiences

CORPORATE GOVERNANCE HIGHLIGHTS

Corporate Governance Practices

We are committed to meeting high standards of ethical behavior, corporate governance, and business conduct. Some of our corporate governance practices include: | | | | | | | | | | | | | | | | | | | | | | | |

| Effective Structure and Composition | | Additional Practices and Policies | | Shareholder Rights |

| ✔ | Independent, experienced Chairperson | | ✔ | Robust director stock ownership guidelines | | ✔ | Single class voting |

| ✔ | Independent committee leadership and strong independent committee membership | | ✔ | Established Board and committee risk oversight practices | | ✔ | Annual election of all directors |

| ✔ | A diverse and highly qualified Board | | ✔ | Board technology/cybersecurity expertise and oversight | | ✔ | Majority voting in uncontested director elections |

| ✔ | Five new directors in the last six years (including four current directors), four of whom are women and two of whom are ethnically diverse | | ✔ | ESG (including climate change) oversight and reporting | | ✔ | Proxy access available |

| ✔ | Mandatory director retirement policy (no exemptions or waivers within the past three years) | | ✔ | Diversity, equity, and inclusion (DEI) oversight and reporting | | ✔ | No poison pill |

| ✔ | Independent directors meet regularly without management | | ✔ | Ongoing director education | | | |

| ✔ | Restrictions limiting the number of public company boards on which a director may serve | | ✔ | Annual Board and committee evaluation process | | | |

Board Risk Oversight

The Board is ultimately responsible for overseeing our risk profile and risk management processes. To facilitate these responsibilities, the Board assigns certain risk oversight responsibilities to each of its main committees through each committee’s charter. The committees continue to undertake the increasingly detailed oversight work for which they are responsible, to interact with and oversee management, and to report back significant matters to the full Board. A more detailed discussion of this oversight function is contained in the “Board Risk Oversight” section of this Proxy Statement.

SUSTAINABILITY AND ESG HIGHLIGHTS

Sustainability and ESG initiatives have been an integral part of the company’s business. Our Core Values are a cornerstone of our business and, as such, are the tenets of these initiatives and have evolved naturally as we work to not only grow our business, but also to support our customers, community, and employees.

The Board’s Approach

The Board and its committees oversee the assessment and management of various sustainability and ESG matters. In their oversight role, our directors ask questions, probe our thinking, provide strategic input, and give guidance informed by their diverse skills and experiences. The following chart highlights some of our Board’s involvement with these matters.

Our Sustainability Efforts

At Progressive, we aim to take a forward-looking approach to everything we do, from the products we offer to the way we interact with the world around us. We work to drive sustainable change for our shareholders, employees, independent agents, communities, and the millions of customers who trust us to protect what is important to them. As our efforts evolve with the world around us, we expect to adapt our sustainability reporting.

Our most recent Corporate Sustainability Report was prepared with guidance from the Nominating and Governance Committee, our executive leadership, and various subject matter experts. The report was informed by elements from various reporting frameworks, namely the Sustainability Accounting Standards Board (SASB) and the Task Force on

Climate-Related Financial Disclosure (TCFD), and includes indices to each of these reporting frameworks. The report provides information regarding our philosophy and practices on a number of topics, including:

To review our most recent Corporate Sustainability Report, please visit our sustainability site at investors.progressive.com/sustainability-reports. The report and any other information on the sustainability site are not incorporated by reference in, and do not form part of, this Proxy Statement or any other SEC filing.

| | |

| Spotlight on Environmental Stewardship |

We continue to make increasing efforts to reduce carbon emissions and operate efficiently in all aspects of our business. We report our environmental efforts to inform our stakeholders of the efforts we are making, the initiatives and steps taken, and the forward movement on our commitments. We continue to advance our environmental stewardship efforts by seeking investments in green energy usage for our facilities, exploring opportunities to shift toward a lower-emissions vehicle fleet, and reducing paper correspondence with our customers. We believe that if we can yield positive environmental results from our business operations, we can create a sustainable business in line with our Core Values.

As we look forward to the future, we are excited to continue to be responsible environmental stewards. We have an aspirational goal of carbon neutrality by the end of 2025 for Scopes 1 and 2, which we believe will help set the path to net-zero in the following decade. To enhance our accountability, we engaged an independent third party to provide limited assurance on our Scope 1 and Scope 2 location-based greenhouse gas emissions reporting. |

HUMAN CAPITAL MANAGEMENT

We believe that our people and our culture remain our most significant competitive advantage, and that having the right people working together in the right way is critical to driving our results, building our enduring business, and creating long-term shareholder value. Our culture is deeply rooted in our Core Values and is the foundation for our human capital management strategies to attract, hire, engage, and retain highly qualified employees.

Our People

We believe that our culture and continued success has enabled us to create a workplace comprised of highly talented people across diverse markets and with a broad range of backgrounds and experiences.

Attract and Hire We employ extensive recruiting practices with a goal of developing qualified and deep candidate pools and attracting candidates from both established and new sources. We believe that our recruitment efforts generally have enabled us to present diverse and high-potential pools of job candidates to our hiring managers. In turn, we train our hiring managers about identifying and avoiding unconscious biases they may have during the interview and selection process and the importance of employing individuals with different kinds of experiences and backgrounds. We believe these strategies collectively enhance our applicant pools and contribute to our continued success.

Engage and Retain We understand that engaged employees are more productive, provide better service to our customers, and are more likely to stay with Progressive. Each year, we survey our people to measure their engagement. We use the results, along with other information, to evaluate our human capital strategies and the health of our culture.

Employee retention is an important part of our strategy. Promoting from within is also a key part of our strategy. Many of our leaders, including most current executive team members, joined Progressive in a more junior position and advanced to significant leadership positions within the organization.

Demographic Data We publish employee and manager demographic information on our website and update this data on an annual basis. We also disclose our consolidated EEO-1 data online.

As of December 31, 2023, we had about 61,400 employees, of which 60% were women and 41% were people of color. We also had about 1,100 senior leaders, of whom 40% were women and 18% were people of color.

Supporting our People and Culture

We strive to support our employees by providing challenging work experiences, career opportunities, and a culture of learning. We are focused on coaching and development, which we believe promotes greater engagement in our business and improved individual performance.

Training and DevelopmentWe actively foster a learning culture and offer several leadership development programs, including our Multicultural Leadership Development Program. Moreover, our personal development strategy, “Career Central,” encourages employees to take control of their careers through team-building exercises, coaching techniques, and communication strategies. Available to new and tenured employees, our learning solutions are tailored to both individual contributors and leaders and cover a broad swath of skills and competencies.

ERGs Over a decade ago, our first Employee Resource Groups (ERGs) were created to help build communities for our employees with common backgrounds, life experiences, interests, or professional goals. We believe that our ERGs support the creation of a space for networking, understanding differences, and sharing experiences. In the time since their inception, our nine ERGs have grown in both influence and size with 44% of Progressive people belonging to at least one of the following ERGs as of December 31, 2023:

•Asian American Network

•Disabilities Awareness Network

•LGBTQ+ Network

•Military Network

•Network for Empowering Women

•Parent Connection

•Progressive African American Network

•Progressive Latin American Networking Association

•Young Professionals Network

Compensation and Benefits As part of employee compensation, nearly all Progressive people participate in our annual cash incentive program, named Gainshare, which measures the growth and profitability of our insurance businesses. We believe Gainshare contributes to the cooperative and collaborative way we work together and, in part, defines our culture. We also monitor overall pay equity among employees with similar performance, experience, and job responsibilities, and publish the results annually on our DEI website. Additionally, our employee benefits are intended to be competitive and to support the needs of our people and their families. We invest in physical, emotional, and financial health of Progressive people by providing a broad range of benefits. For example, during 2023, we expanded

our benefits for entry level employees to include a lower-cost health insurance plan which retains the same level of benefits as comparable regular-priced plans.

Diversity, Equity, and Inclusion

We believe that in order to be consumers’, agents’, and business owners’ number one destination for insurance and other financial needs, we need to anticipate and understand the needs of our customers. Therefore, we seek to be diverse in our employee demographics, experiences, and perspectives.

Our commitment to diversity starts at the top with our highly skilled and diverse Board, as discussed above. We are one of the few public companies with a female Chief Executive Officer (CEO), as well as a female independent Board Chairperson. Our DEI efforts are overseen by our Compensation and Talent Committee on behalf of the entire Board, and those efforts are implemented at all levels of the organization.

For Progressive, DEI is not just a program, initiative, or singular goal. We take a holistic approach to DEI guided by four primary objectives, which have been in place for several years:

•To maintain a fair and inclusive work environment

•To reflect the customers we serve

•For our leaders to reflect the people they lead

•To contribute to our communities

A few years ago, for instance, we introduced an ambitious aspiration to double the representation of people of color in senior leadership from 10% to 20% by the end of 2025. We set this aspiration to challenge ourselves to reach far and wide to attract diverse, highly qualified applicant pools when recruiting opportunities arose, to invest broadly in developing our internal talent, and to help measure the success of these efforts. During 2023, representation of people of color in senior leadership increased from 17% to 18%.

We’re committed to creating an environment where all our people feel welcomed, valued, and respected, and we integrate DEI into our workplace. This includes hosting regular Inclusion Quarterly events which feature a series of speakers, discussion groups, and storytelling focused on the themes of diversity, equity, and inclusion. We also have DEI leadership job objectives for our executive team and managers aimed at fostering a diverse and inclusive workplace.

Moreover, we support efforts to contribute to our communities, through our Keys to Progress® programs (which include providing vehicles to veterans and furnishing homes for individuals

emerging from homelessness), our various education and engagement efforts, and our financial contributions to various community organizations.

For over 20 years, we have also contributed to The Progressive Insurance Foundation, which provided matching funds to eligible 501(c)(3) charitable organizations to which employees contributed. To more broadly represent our employees and their communities, in 2020, The Progressive Insurance Foundation began funding national charitable organizations identified by our ERGs. Beginning in mid-2022, in lieu of matching funds and through the Name Your Cause® program, each employee can recommend an eligible charity to receive a fixed amount of the Foundation's charitable giving without requiring the employee to make an out-of-pocket donation. This is the Foundation’s way of supporting more causes and reaching more communities across the country where Progressive’s people, and its customers, live and work.

We know we still have much more work to do, but we are committed to these efforts. To learn more visit our DEI site at progressive.com/about/diversity-and-inclusion. The information on the DEI site is not incorporated by reference in, and does not form part of, this Proxy Statement or any other SEC filing.

See “Compensation Discussion and Analysis – Elements of Compensation – The Role of Diversity, Equity, and Inclusion” for more information.

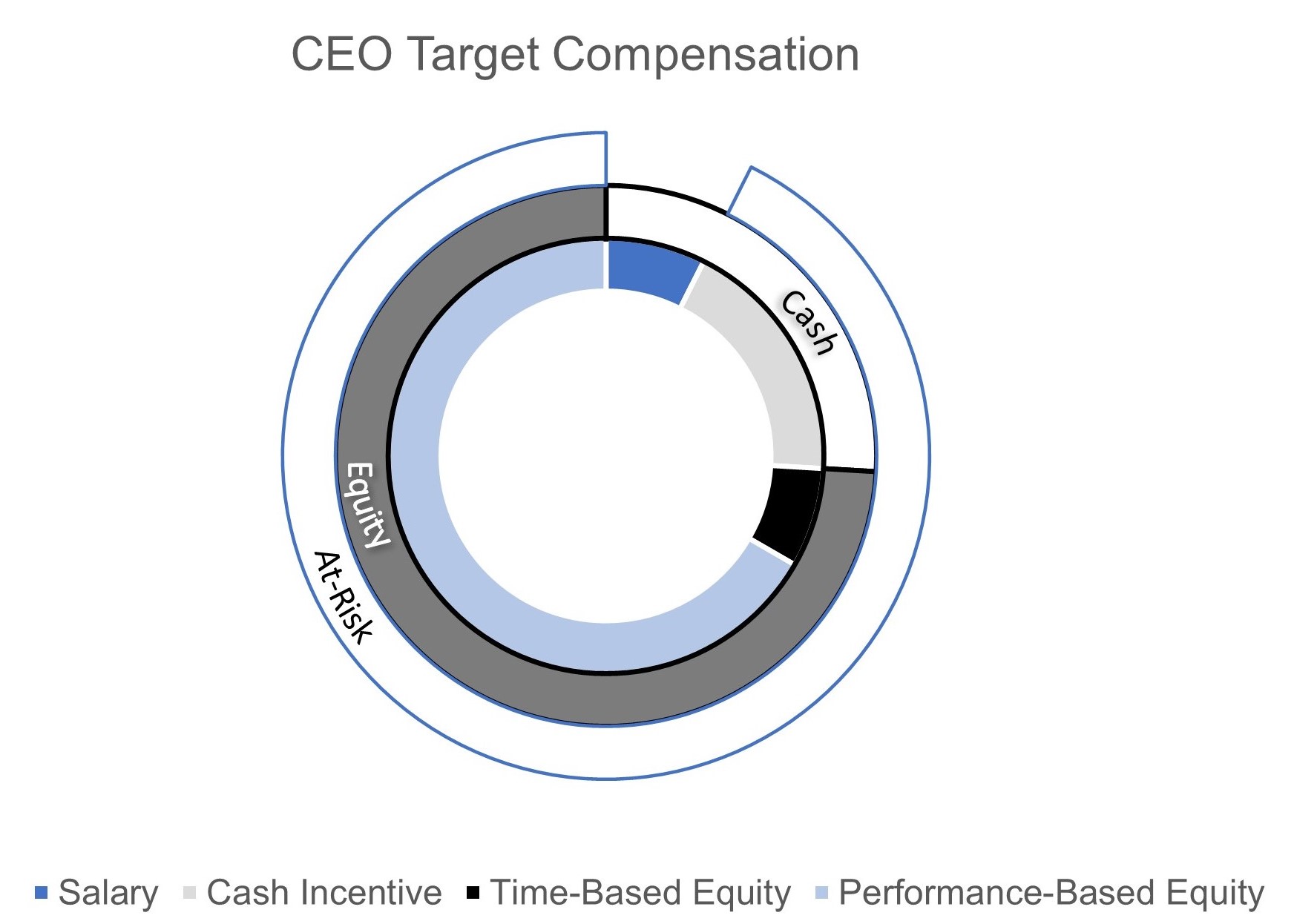

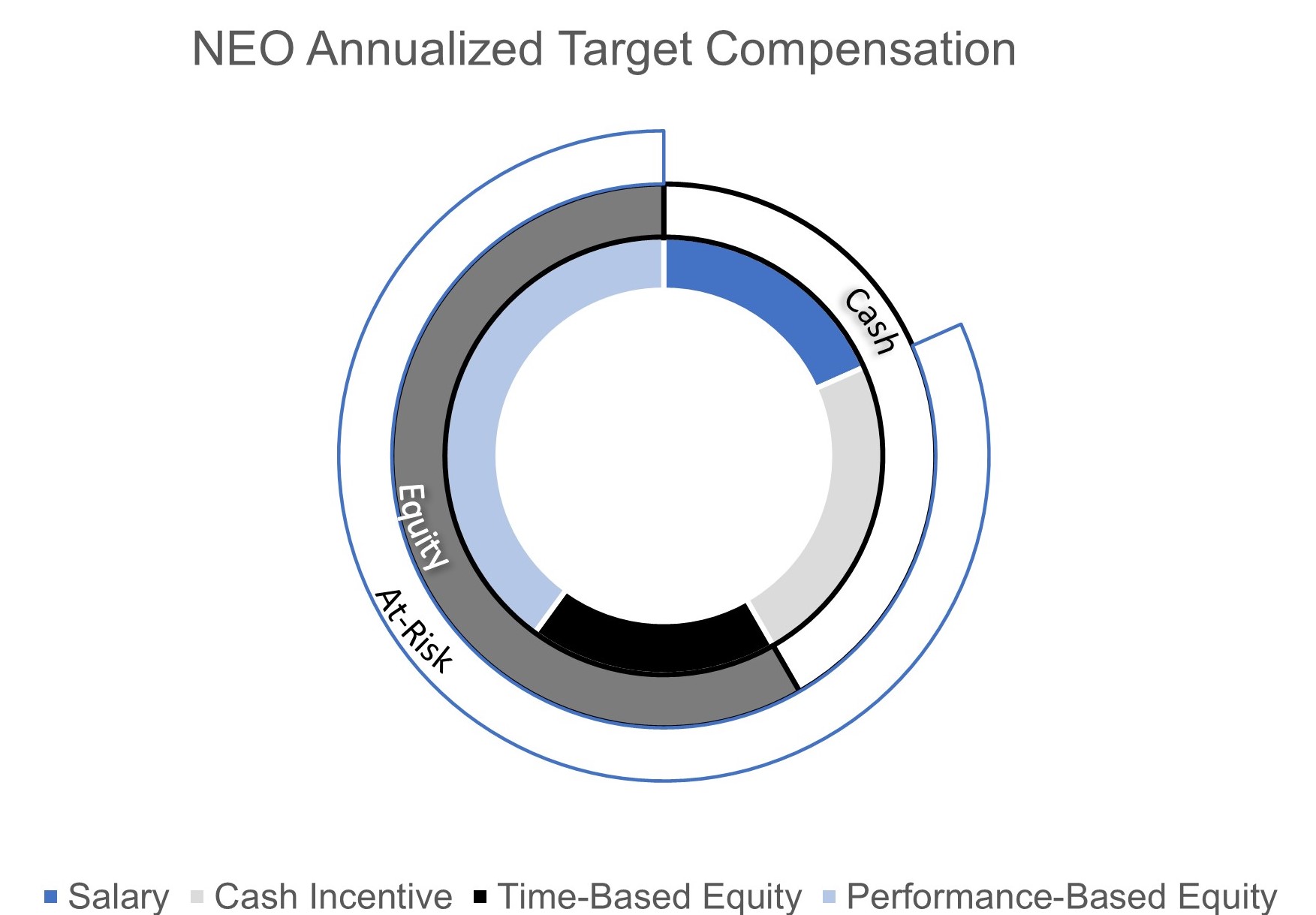

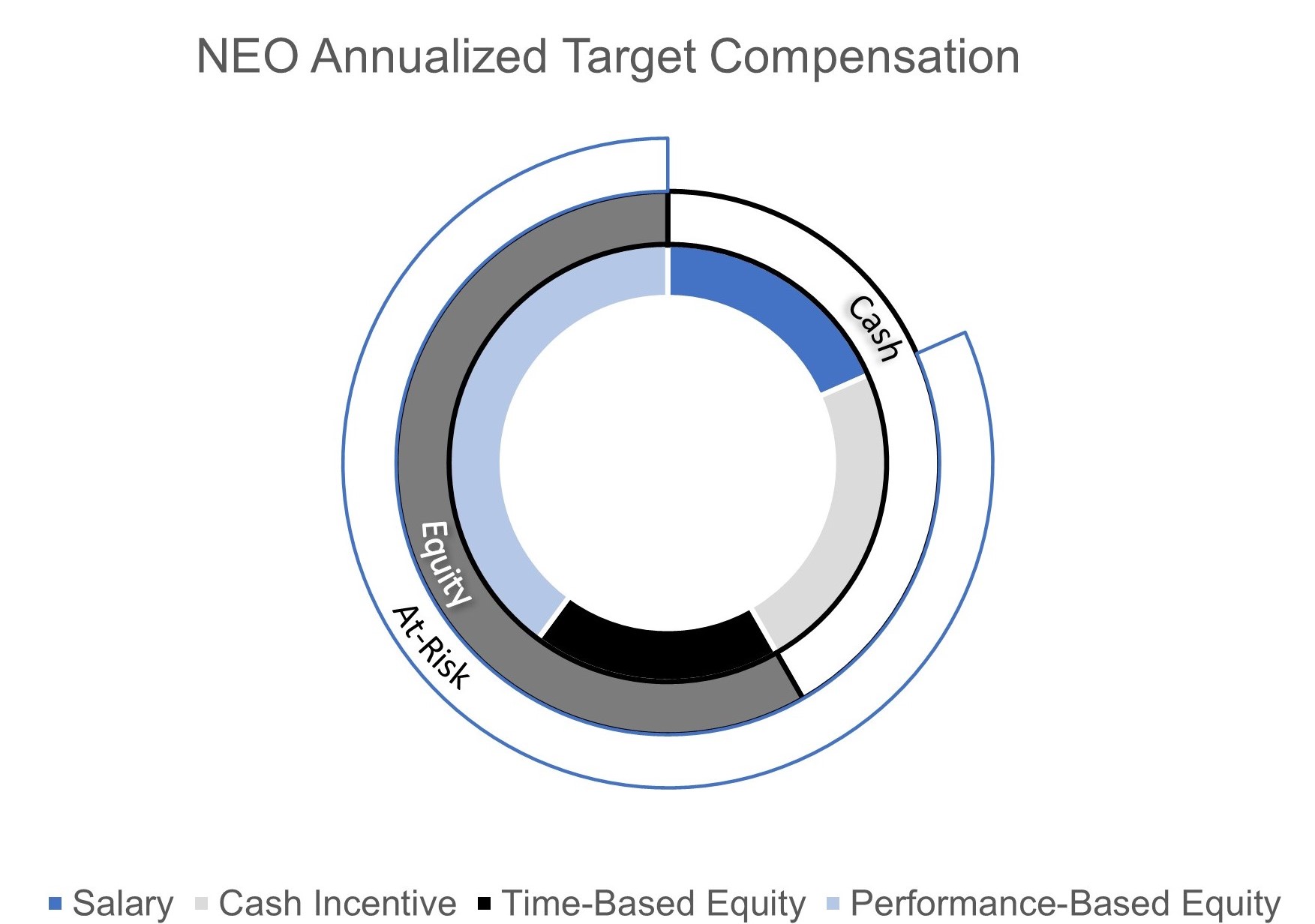

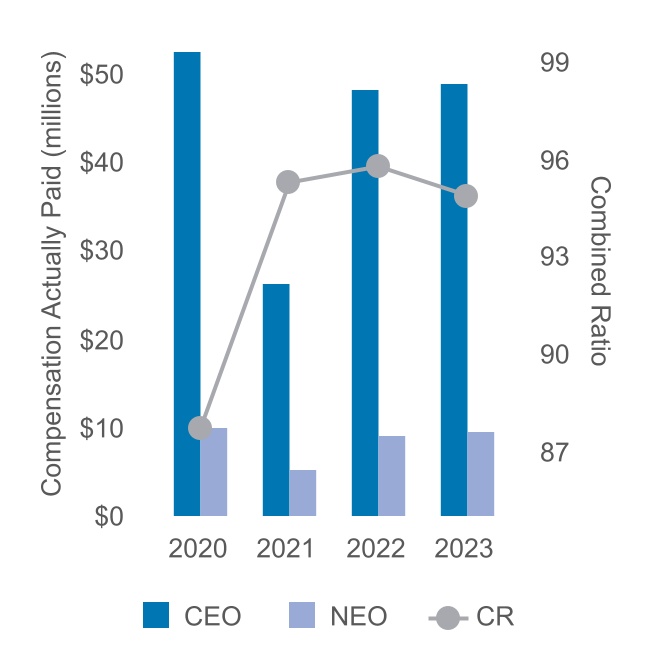

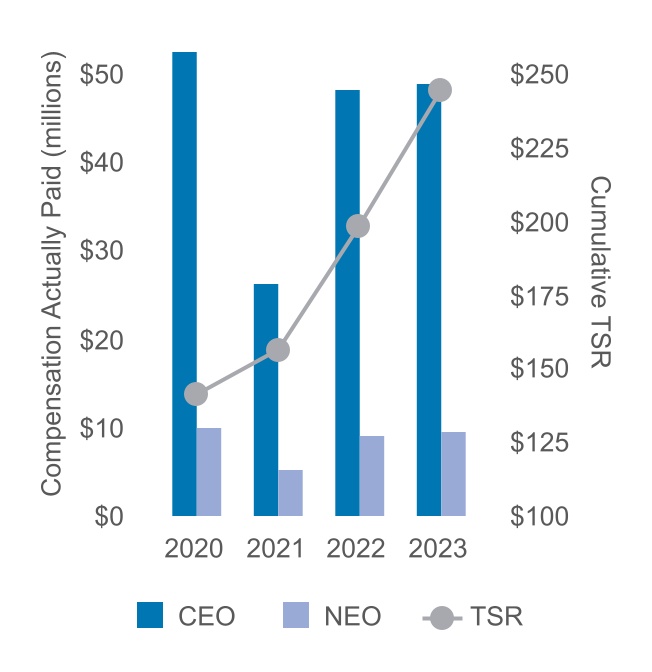

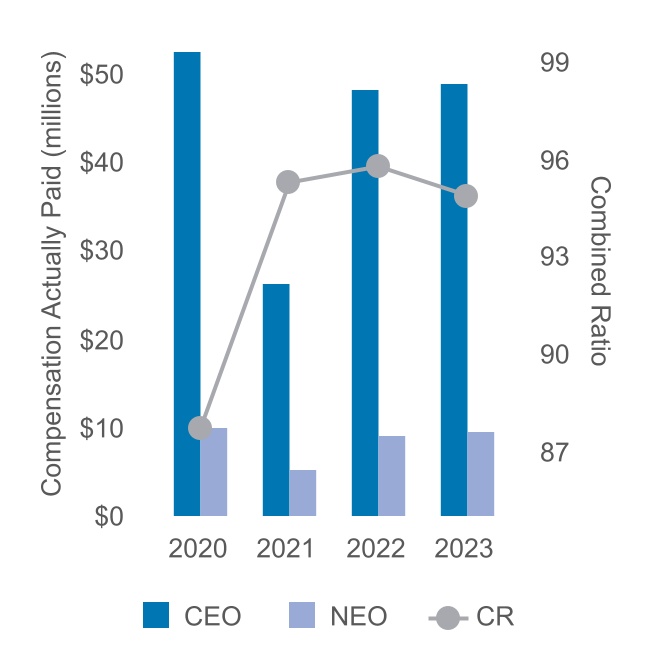

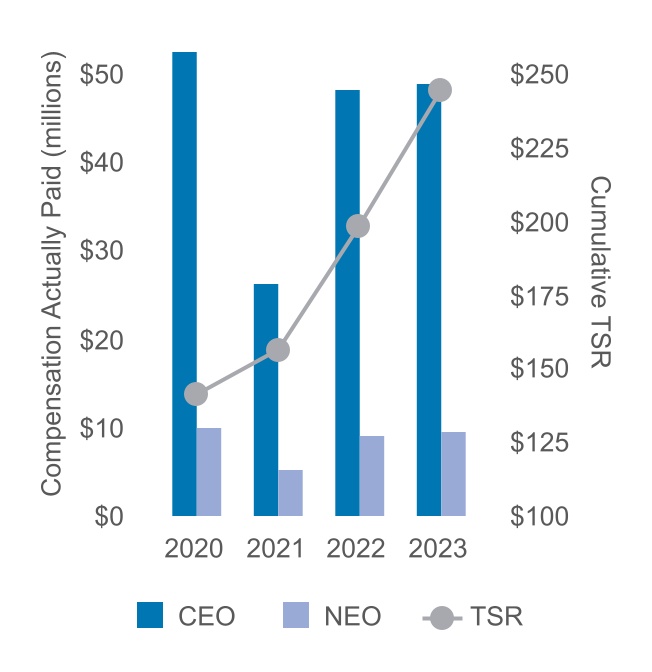

EXECUTIVE COMPENSATION HIGHLIGHTS

We believe that our executive compensation program has been a critical component of our strong operating results and, in turn, shareholder returns in recent years. We generally provide target compensation to our executives at or below the market median, with performance-based compensation providing upside potential when we perform well against pre-established and objective measures. In addition, we provide a significant percentage of total compensation to executives in the form of performance-based equity awards. In furtherance of our long-standing goal to grow as fast as we can at a 96 or better combined ratio while continuing to deliver high-quality customer service, we use the combined ratio as a performance measure in several compensation elements.

We believe that the overall structure of our executive compensation program supports a strong pay-for-performance linkage and aligns the interests of our executives with those of our shareholders. For example, during the past five years:

•We grew faster than the markets for the insurance business lines we measure, resulting in

the related vesting of the performance-based restricted stock unit awards above target;

•We achieved above-market longer-term fixed-income portfolio performance, resulting in the vesting of the performance-based restricted stock unit awards that reflect our investment results above target; and

•Our Gainshare program paid out an average of 162% of target based on the growth in average policies in force and profitability of our insurance businesses (for 2023, it paid out at 178% of target).

Our executive compensation program is overseen by the Compensation and Talent Committee of the Board. The Committee's decisions are made after considering third-party compensation data for comparable companies, internal analyses, and recommendations presented by management. The executive compensation decisions for executive officers generally represent the culmination of extensive analysis and discussion, which typically take place over the course of multiple committee meetings and in meetings between the committee and management, including our CEO, our Chief Human Resources Officer, members of our compensation and law departments, and sometimes compensation consultants.

Our executive compensation program has a number of important structural features and guiding policies. Below are the executive compensation practices we follow:

| | | | | | | | | | | |

| What We DO Have | | |

| ✔ | Independent Compensation and Talent Committee that establishes compensation for executive officers | |

| |

| ✔ | Heavy weighting of at-risk “pay for performance” compensation | |

| |

| ✔ | Typically below market base salary with opportunity to exceed median with strong performance | |

| |

| ✔ | Stock ownership guidelines | | |

| ✔ | Clawback/forfeiture provisions (including restatements and reputational harm) and a separate Dodd-Frank Clawback Policy | |

| |

| ✔ | DEI-related goal embedded into each executive officer’s job objectives, which factors into setting overall annual target compensation | |

| |

| |

| | | | | | | | |

| What We DON’T Have | |

| ✘ | Employment agreements | |

| | |

| ✘ | Guaranteed salary increases or bonuses | |

| | |

| ✘ | Hedging/pledging of our stock | |

| | |

| ✘ | “Timing” of equity awards | |

| | |

| ✘ | Single-trigger change in control benefits | |

| | |

| ✘ | Pension plan or supplemental retirement benefits provided to executives |

|

| | |

We seek to provide transparency into our business, our performance, our strategic priorities, our governance practices, and how our Core Values guide our decisions and support our culture. We share information with our stakeholders in a variety of ways, including monthly earnings releases, quarterly investor calls, annual shareholder meetings, quarterly letters from our CEO, and annual letters from our Chairperson of the Board.

We recognize the value in maintaining open lines of communication with our stakeholders and engage with our stakeholders throughout the year to:

•provide visibility and transparency into our business, our performance, and our corporate governance, ESG, and compensation practices;

•discuss with our investors the issues that are important to them, hear their expectations for us, and share our views; and

•assess emerging issues that may affect our business, inform our decision making, and enhance our corporate disclosures.

ITEM 1: ELECTION OF DIRECTORS

Our Code of Regulations establishes the number of directors at no fewer than five and no more than 13. The number of directors has been fixed at 12, and there are currently 12 directors on the Board. As stated in our Corporate Governance Guidelines, the Board may change the size of the Board from time to time depending on its needs and the availability of qualified candidates. In this proposal, we are asking shareholders to elect as directors the 12 nominees named below.

Each director elected will serve a one-year term and until their successor is duly elected. If, by reason of death or other unexpected occurrence, any one or more of the nominees named below is not available for election, the proxies will be voted for substitute nominee(s), if any, as the Board may propose. In the alternative, the Board may decide to reduce the size of the Board prior to the 2024 Annual Meeting or fill the vacancy at a later date. (The deadlines for shareholders to nominate one or more individuals for election to the Board at the Annual Meeting have passed.)

NOMINEES FOR DIRECTOR

Based upon a recommendation from the Board’s Nominating and Governance Committee, the Board has nominated the following persons for election to the Board of whom 11 are current directors and one is a new nominee:Board:

•Danelle M. Barrett

•Philip Bleser

•Stuart B. Burgdoerfer

•Pamela J. Craig

•Charles A. Davis

•Roger N. Farah

•Lawton W. Fitt

•Susan Patricia Griffith

•Devin C. Johnson

•Jeffrey D. Kelly

•Barbara R. Snyder

•Kahina Van Dyke

Information regarding the nominees can be found below under “– Director Nominee Highlights” and “ – Director Nominee Information.”

| | | | | | | | | | | | | | |

| The Board of Directors recommends that you vote FOR the election of each nominee. |

DIRECTOR NOMINEE SELECTION PROCESS

The Board is responsible for recommending director candidates for election by the shareholders and for electing directors to fill vacancies or newly created directorships. The Board has delegated the screening and evaluation process for director candidates to the Nominating and Governance Committee, which identifies, evaluates, and recruits highly qualified

director candidates and recommends them to the Board.

Qualifications, Experiences, and Skills

The Nominating and Governance Committee evaluates each director candidate individually when considering whether the candidate should be nominated to serve on the Board. The committee will give due consideration to factors deemed relevant by the committee or the Board, including whether the candidate possesses the general qualities required to serve successfully as a director, including: intelligence, thoughtfulness, diligence, judgement,judgment, character, and commitment.

The committee reviews the candidate’s relevant experiences, the extent of their demonstrated excellence and success in their chosen career and the specific attributes, skills, talents, or knowledge the candidate would be expected to add to the Board.

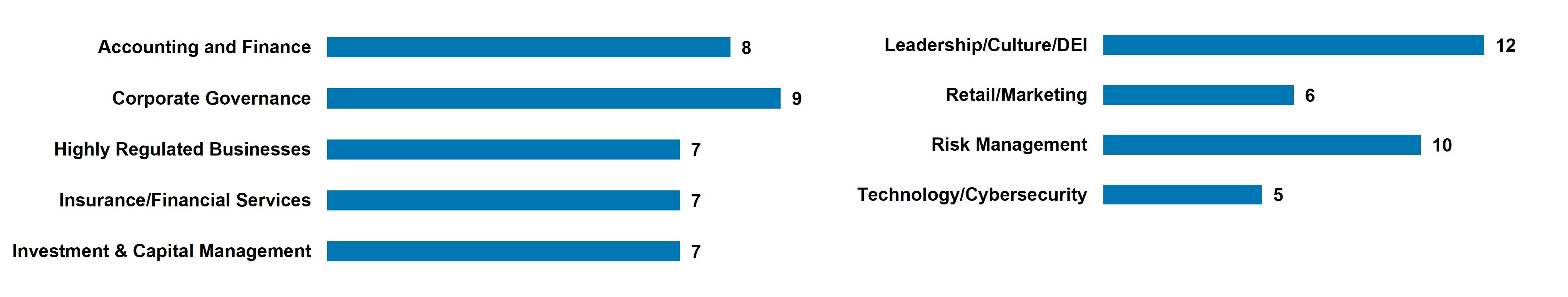

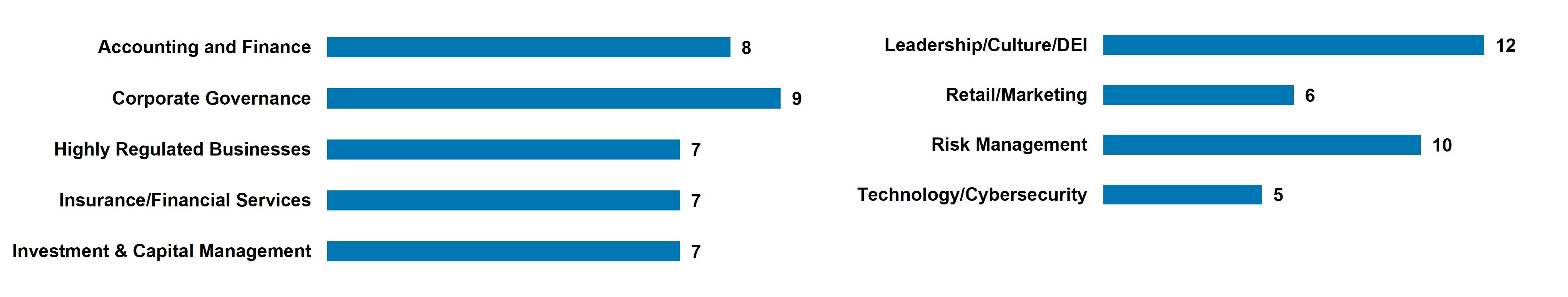

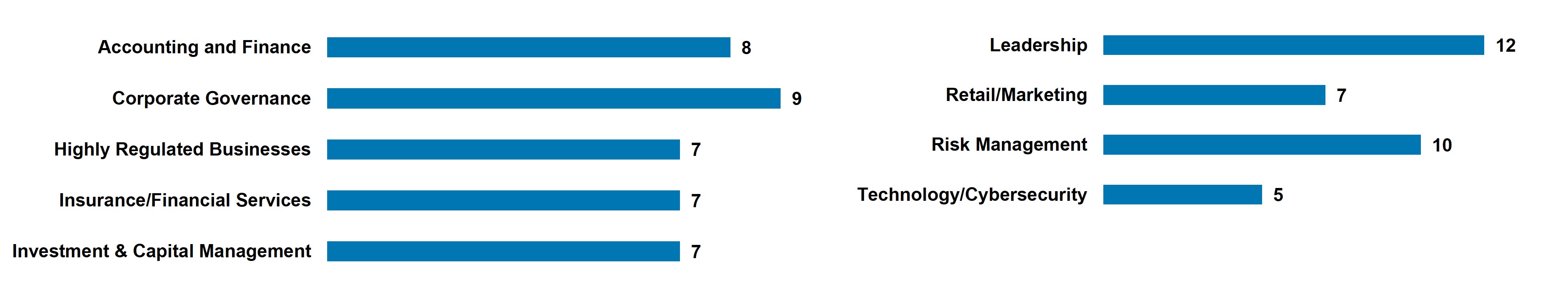

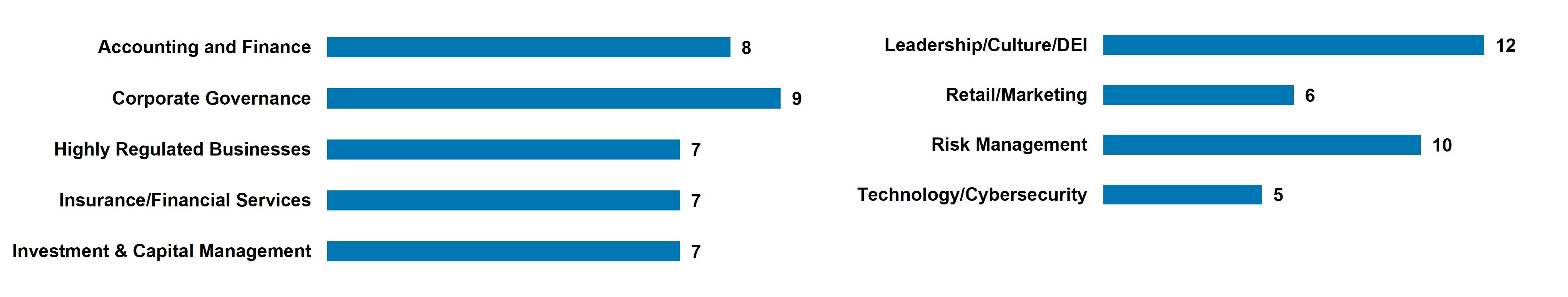

In addition to the qualifications that each director nominee must have, the Board believes that one or more of its Board members should possess the following experiences and expertise because of their particular relevance to the company’s business, strategy, and structure. These experiences and expertise were considered by the committee in connection with this year’s director nomination process:

•Accounting & Finance

•Corporate Governance

•Highly Regulated Businesses

•Insurance/Financial Services

•Investment & Capital Management

•LeadershipLeadership/Culture/DEI

•Retail/Marketing

•Risk Management

•Technology/Cybersecurity

The committee also considers the company’s and the Board’s needs, the qualifications of other available candidates, and how the addition of the candidate to, or the continued service on, the Board would enhance the Board’s overall diversity and capabilities.

Diversity

The Board’s policy is to include individuals with a wide variety of tenure, talents, skills, experiences, and perspectives, in addition to considering demographic criteria such as race, ethnicity, sexual orientation, gender, nationality, age, and disability, whenever possible. The directors believe that such diversity provides the Board with broader perspectives, a wide array of thoughts and ideas, and insight into the views and priorities of our diverse investor, customer, independent agent, and employee bases.

The committee’s work in recruiting new members will continue to reflect their commitment to achieve such diversity. To evaluate the impact of the addition of a

candidate on the diversity of the Board, the committee considers how distinct the candidate’s background, experiences, skills, and personal characteristics are from those of the incumbent directors and whether the candidate would bring a unique perspective to the Board. The committee assesses the effectiveness of its practices for consideration of diversity in nominating director candidates by periodically analyzing the diversity of the Board as a whole and, based on that analysis, determining whether it may be desirable to add to the Board a director with a certain type of background, talent, experience, personal characteristic, skill, or a combination thereof.

Other Public Company Board Commitments

The Board expects that each director will devote sufficient time and effort as necessary to serve as a director and as a member of the Board’s committee(s) to which the director may be assigned.

Therefore, in accordance with our Corporate Governance Guidelines:

•directors that are actively involved in an executive capacity with the company or another publicly held company can sit on no more than two public companies' boards in addition to the company (excluding subsidiaries or companies in which the director’s employer holds an investment); and

•directors that are not actively involved in management of the company or another company (including a non-executive board chairperson) can sit on no more than four public companies' boards in addition to the company.

Director commitment levels, including public company board leadership positions, are reviewed at least annually to confirm that each director has sufficient time to perform their duties. All directors are compliant with this expectation at this time.

DIRECTOR NOMINEE HIGHLIGHTS

Director Nominee Diversity

We are one of a few companies in the Fortune 500 with a female CEO, as well as a female independent Board chairperson. The nominees include a diverse mix of directors.

Director Nominee Experiences, Qualifications, Attributes, and Skills

The Board believes that it is desirable that the following experiences, qualifications, attributes, and skills be possessed by one or more of its Board members because of their particular relevance to the company’s business and structure, and these were all considered by the Nominating and Governance Committee in connection with this year’s director nomination process:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Accounting & Finance | Corporate Governance | Highly Regulated Businesses | Insurance/ Financial Services | Investment & Capital Management | LeadershipLeadership/ Culture/DEI | Retail/Marketing | Risk Management | Technology/Cybersecurity |

| Danelle M. Barrett | | l | l | | | l | | l | l |

| Philip Bleser | l | l | l | l | l | l | l | l | |

| Stuart B. Burgdoerfer | l | l | | | l | l | l | l | |

| Pamela J. Craig | l | l | | | l | l | | l | l |

| Charles A. Davis | l | l | l | l | l | l | | l | |

| Roger N. Farah | l | l | | | | l | l | l | |

| Lawton W. Fitt | l | l | l | l | l | l | | l | |

| Susan Patricia Griffith | | l | l | l | | l | l | l | |

| Devin C. Johnson | l | | | | | l | l | | l |

| Jeffrey D. Kelly | l | l | l | l | l | l | | l | |

| Barbara R. Snyder | | | l | l | | l | | ll | l |

| Kahina Van Dyke | | | | l | l | l | l | | l |

DIRECTOR NOMINEE INFORMATION

The following information is provided for each nominee and includes descriptions of each nominee’s specific experience, qualifications, attributes, and skills that led the Nominating and Governance Committee and the Board to conclude that the nominee should serve on the Board. Unless otherwise indicated, each nominee has held the principal occupation indicated for more than five years. Current directorships and former directorships (held during the last five years) at other public companies are also shown. The term of each current director expires at the Annual Meeting.

| | | | | | | | |

| Name (Age) | Principal Occupation, Business Experience, and Qualifications | Other Directorships |

Danelle M. Barrett (55)(56)

Director since: Not Applicable2023 | U.S. Navy, Rear Admiral, Retired; Cybersecurity Division Director and Deputy Chief Information Officer (military)

Danelle M. Barrett has been nominated to serve as one of our directors. Prior to retiring, Rear Admiral Barrett served in Navy leadership positions with the U.S. Navy for 30 years. She most recently served as the Navy Cybersecurity Division Director and Deputy Chief Information Officer on the Chief of Naval Operations staff from 2017 to 2019, where2019. In this role, she led the U.S. Navy’s strategic development and execution of digital and cybersecurity efforts, including key enterprise information technology modernization improvements to enhance warfighting and business operations. Rear Admiral Barrett also held several prior leadership positions, including Director of Current Operations at the U.S. Cyber Command and the Chief of Staff at the Navy Information Forces Command. She received her commission as an officer from the U.S. Naval Reserve Officer Training Corps. In addition to holding a M.A.She has several advanced degrees in National Security Strategic Studies from the U.S. Naval War College, she also holds a M.S. in Information Managementnational security strategic studies, information management, and two additional M.A.s in Management and Human Resource Development.human capital management, among others. In addition to her current and past service as a director of two public companies, including serving as a member of their compensation and governance committees, Rear Admiral Barrett brings to the Board extensive leadership and operational experiences in complex cybersecurity matters, digital modernization and innovation, information technology systems, technology risk management, and strategic assessment, planning, and implementation.

| Current ShoulderUp Technology Acquisition Corp

Former

KVH Industries, Inc. |

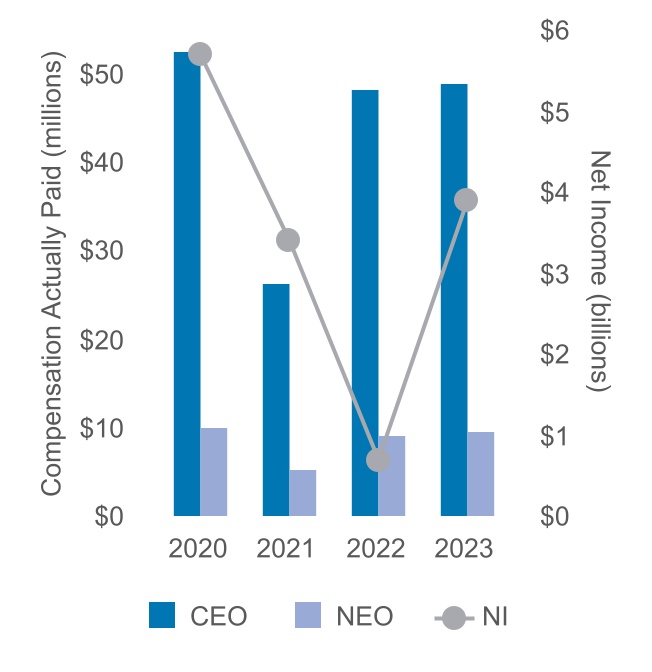

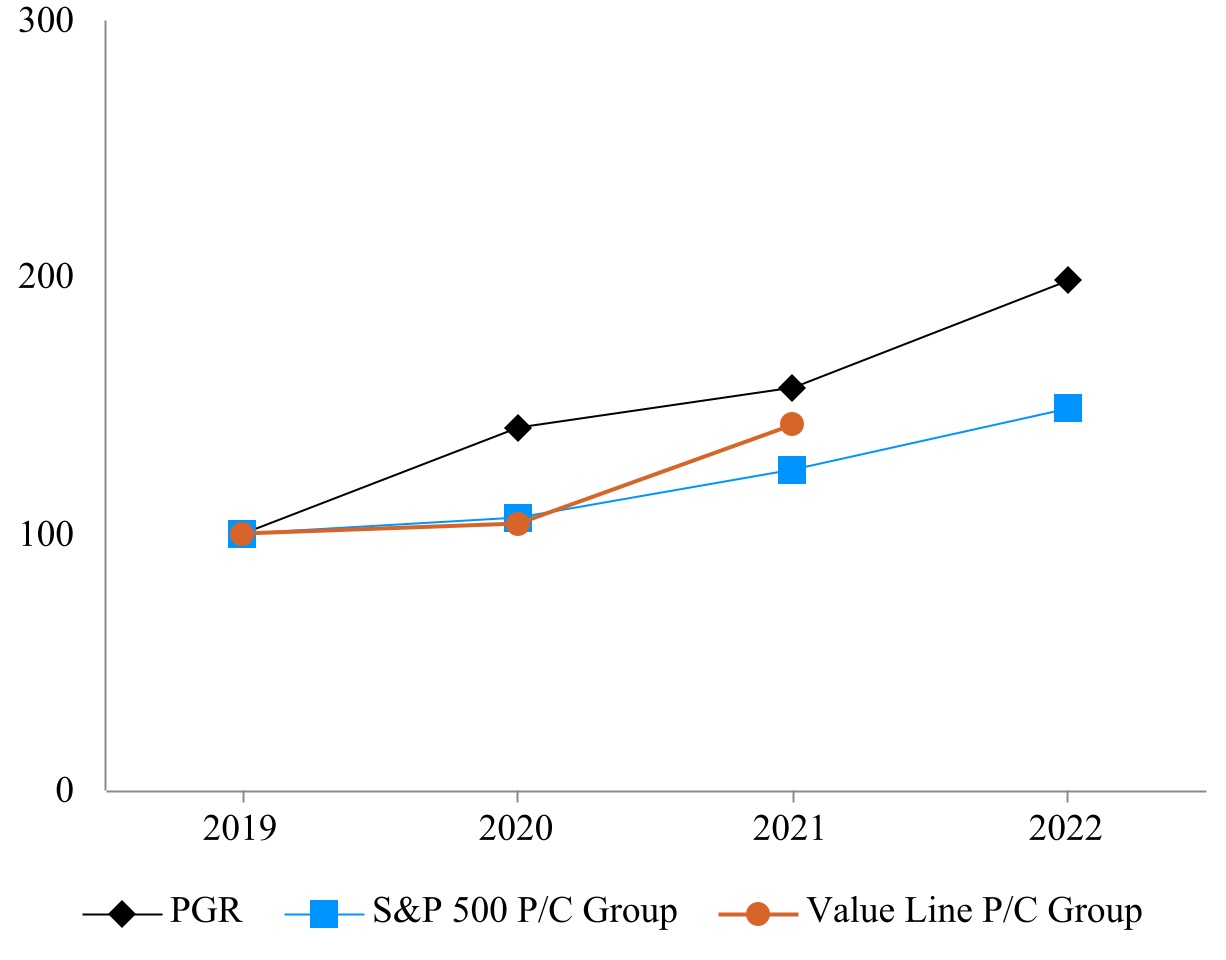

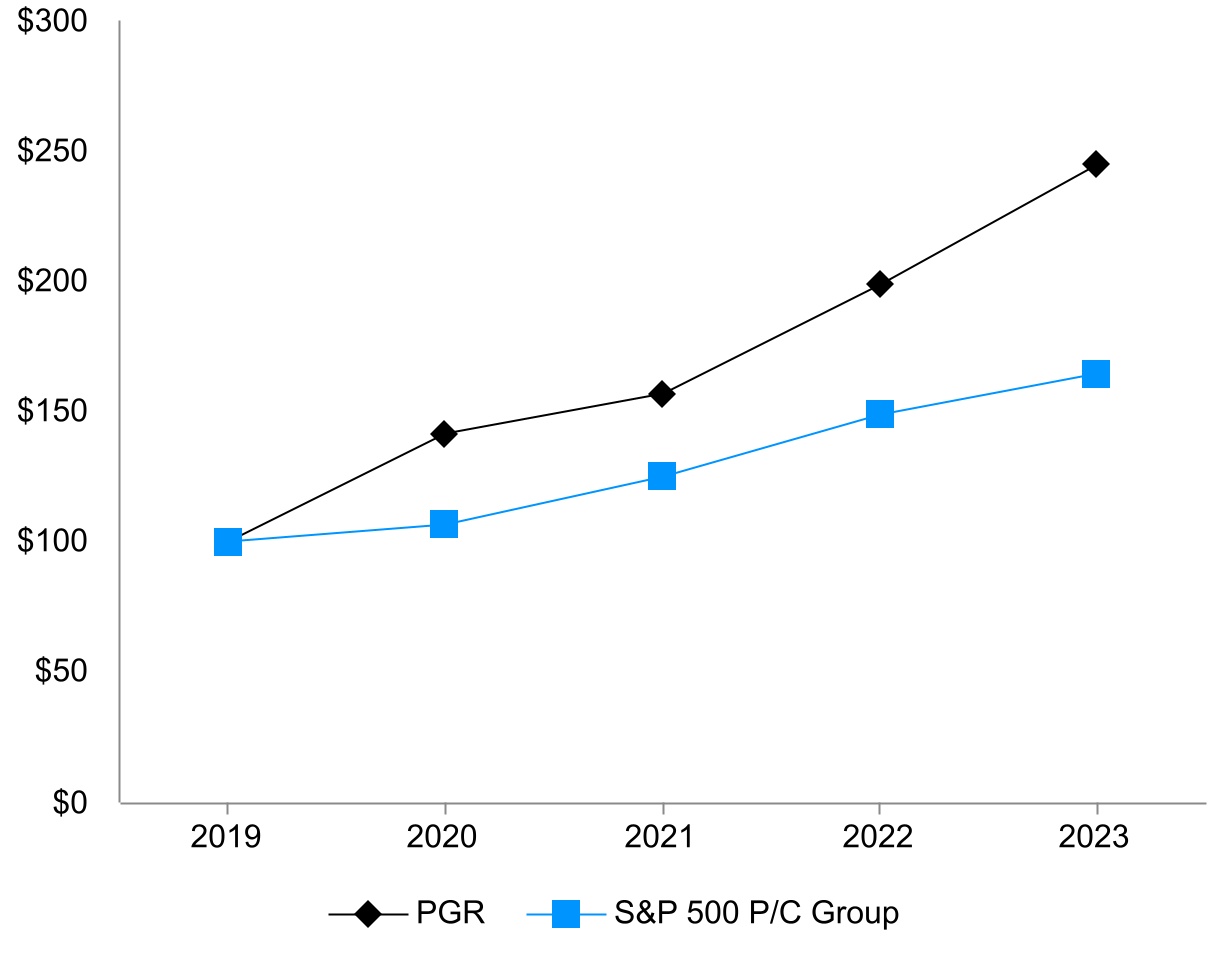

|